Smart Arbitrage

1. What is a Smart Arbitrage Strategy?

A smart arbitrage strategy is a method aimed at achieving stable profits by hedging against market price fluctuations. Its core principle is to use a Delta-neutral strategy, which involves holding positions of equal size but opposite direction in the spot market and the perpetual swap market to hedge against price changes.

Specifically, the smart arbitrage strategy involves buying (long) a certain crypto in the spot market while simultaneously selling (short) the same quantity of that crypto in the perpetual swap market. This way, regardless of how market prices fluctuate, the gains and losses of these two positions can offset each other, thereby reducing the risk brought about by price volatility. Users mainly achieve profits through the funding fees collected during the holding period (such as the gains under a positive funding rate).

The smart arbitrage strategy on OKX includes two modes:

Custom Mode: Users can choose strategies with high annualized returns based on their own analysis and set their own take-profit strategy.

Smart Mode: The system will automatically recommend the optimal strategy for the user and intelligently perform take-profit, stop-loss, and position adjustment operations.

2. Scenarios Where Smart Arbitrage Strategy is Applicable

The Smart arbitrage strategy is particularly suitable for mainstream cryptocurrencies that have a positive funding rate over the long term. This is because, under the designed mechanism of funding rates, many mainstream cryptocurrencies typically maintain a positive funding rate, which means investors can earn funding fee income over the long term by holding positions in these cryptocurrencies.

In the custom mode, it is recommended that users choose cryptocurrencies and trading pairs with the following conditions:

Positive Long-term Funding Rate: Select cryptocurrencies that have historically and currently maintained a positive funding rate over the long term.

High Liquidity Trading Pairs: Choose trading pairs with good liquidity to reduce the spread during opening and closing positions, thereby reducing slippage costs and improving overall returns.

By meeting these conditions, users can better utilize the smart arbitrage strategy to achieve stable funding fee income while hedging against price risks. This strategy is suitable for investors who aim for steady returns in highly volatile markets, especially those who do not have the time or experience to manually manage strategies.

3. Example Tutorial and Arbitrage Calculation

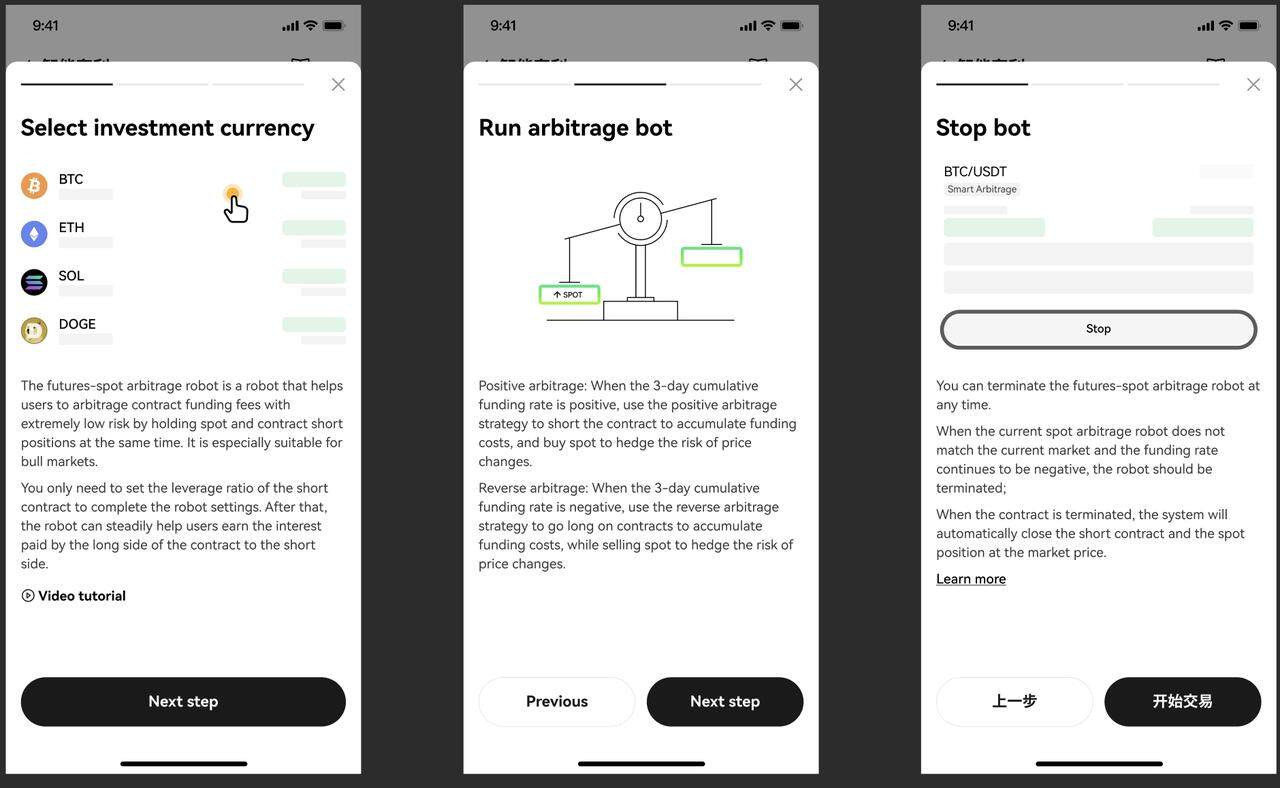

3.1 Intelligent Arbitrage Order Process:

After selecting the trading pair, set the investment amount in three steps, and place the order with one click.

3.2 Investment Costs:

3.2.1 Fees:

Taking user Level 1 as an example, the fees involved in starting arbitrage include spot buy (0.1%), perpetual swap opening (0.05%), perpetual swap closing (0.05%) when ending arbitrage, and spot sell (0.1%). Typically, it takes more than 7 days to offset these fees. It is recommended that novice users hold their arbitrage positions for a longer period.

3.2.2 Basis Change Cost between Spot and Perpetual Swap:

For example, if the spot price is 65,000 and the perpetual swap price is 64,900, the entry basis is -100. If, at the end of the strategy, the spot price is 69,000 and the perpetual swap price is 69,100, the exit basis is 100. Therefore, you will incur a loss due to the widening basis of -[100 - (-100)] = -200 points * Qty. With a 5x leverage, this roughly accounts for 0.26% of the cost. We also recommend looking for opportunities to enter when the basis is large and exit when the price spreads narrows to reduce this part of the cost.

3.3 Arbitrage Earnings:

Using BTC as an example, if you use 2,100 USDT for smart arbitrage, and the BTC spot price is 65,000 USDT, you can perform the following operations:

Assuming a leverage of 20x, we allocate 2,000 USDT to buy spot BTC, and 100 USDT to short BTC/USDT perpetual swap with 20x leverage.

Buy 2,000 USDT worth of BTC in the spot market (0.03077 BTC), while shorting the same amount of BTC in the perpetual swap market with 20x leverage (requiring a margin of 100 USDT).

If the current funding rate is 0.01% and the BTC price is 65,000 USDT, you will receive the funding rate for the short contract position, 2,000 * 0.01% = 0.2 USDT.

Assuming the rate remains at 0.01%, with a payment cycle of 8 hours, you receive funding fees 3 times a day. Annually, this would amount to 0.2 * 3 * 365 = 219 USDT, which annualizes to 219 / 2,100 = 10.43%.

4. Precautions

4.1. Although the smart arbitrage strategy carries relatively low risk during long-term operation, the following risks still exist:

Slippage Risk when Closing Positions: Due to the different liquidity of the spot and perpetual swap markets, slippage may occur when opening or closing positions simultaneously. However, OKX offsets these costs by setting a larger profit threshold, ensuring relatively stable returns in the long run.

Delta Inconsistency Risk: Although smart arbitrage strategy aims to achieve Delta neutrality, differences in the efficiency of opening and closing positions in the spot and perpetual swap markets may lead to short-term Delta inconsistencies. OKX will quickly adjust single-leg orders upon detecting Delta inconsistencies to eliminate Delta risk. Note that during extreme market volatility, Delta inconsistency risk is amplified, thus requiring careful management.

Forced Liquidation Risk of Short Contracts: When opening long or short positions in the perpetual swap market, there is a risk of forced liquidation if the market moves against the position direction. OKX will automatically reduce positions to a safer level when the contract risk rate falls below 300% to reduce the risk of forced liquidation.

ADL Risk: Due to the presence of positions in the contract market within the smart arbitrage strategy, there is a risk of automatic deleveraging (ADL) during extreme market volatility. OKX minimizes ADL risk through stringent risk control strategies.

4.2. Once the smart arbitrage strategy is created, the invested funds are isolated from the trading account and used independently within the arbitrage strategy. Therefore, users need to be aware of the risks to the overall position in the trading account after funds are transferred out.

4.3. When stopping the smart arbitrage strategy, the trading currency will be sold at the market price. If the risk control system determines that this may pose a risk to the market, the sale may fail, and users can decide whether to continue selling the currency manually.

4.4. If during the operation of the smart arbitrage strategy, cryptocurrency faces unpredictable abnormal situations such as suspension or delisting, the intelligent arbitrage strategy will automatically stop.

5. Disclaimer

This article may contain product-related content that is not applicable to your region. It is intended to provide general information only and does not accept responsibility for any factual errors or omissions. The views expressed in this article are solely those of the author and do not represent the views of OKX.

This article is not intended to provide any of the following types of advice, including but not limited to: (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice.

Holding digital assets (including stablecoins and NFTs) involves high risk and may fluctuate significantly, potentially becoming worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For questions about your specific circumstances, please consult your legal/tax/investment professionals.

The information presented in this article (including market data and statistical information, if any) is for general reference only. While all reasonable precautions have been taken in preparing these data and charts, we accept no responsibility for any factual errors or omissions expressed herein.