How do I trade smart with the right leverage?

At OKX, your asset security and long-term PnL are extremely important to us. As setting a high copy trading leverage can bring significant risks, we recommend keeping your copy trading leverage at 20x or lower to protect your assets and avoid potential losses.

What are the risks of high copy trading leverage?

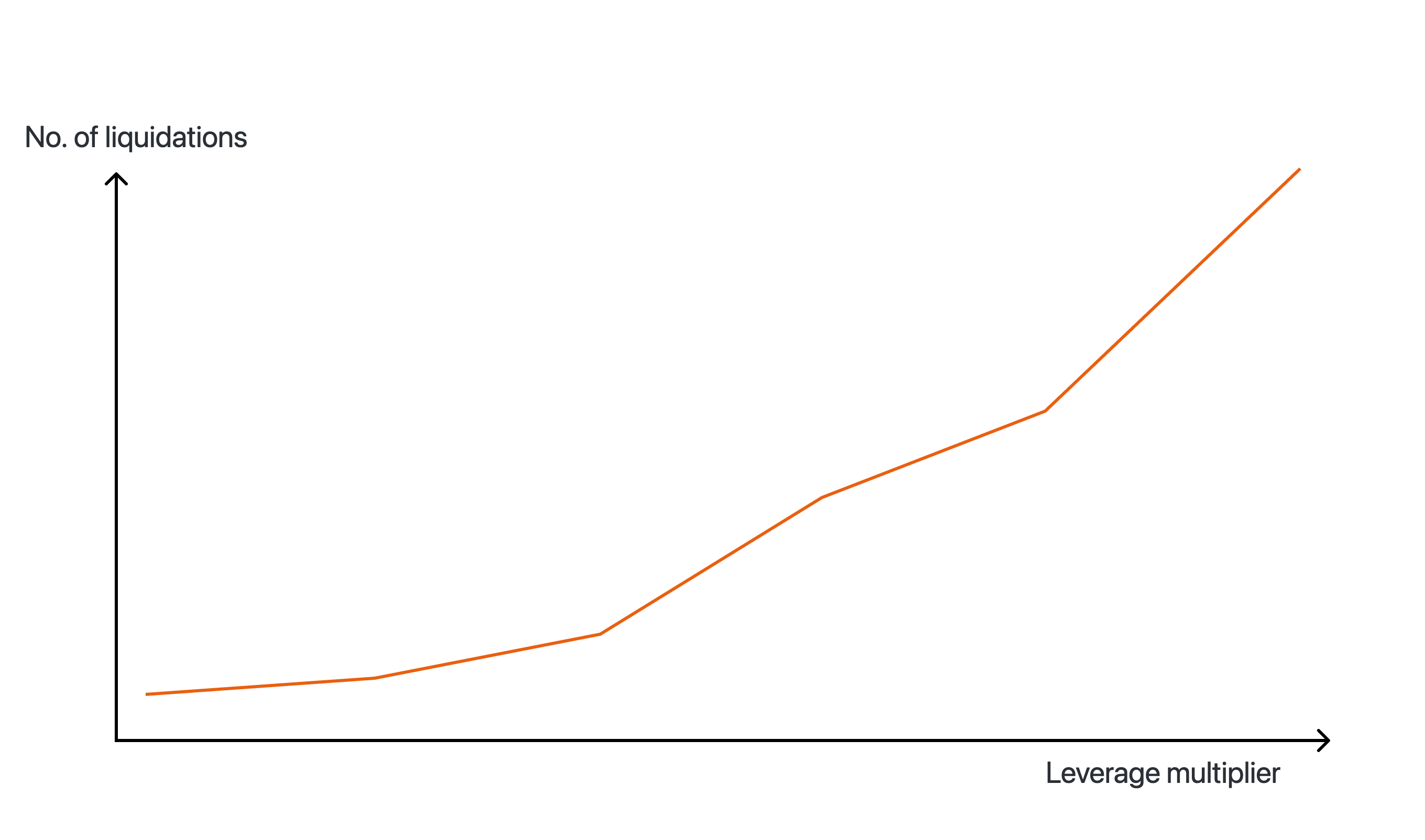

Our copy trading data shows that an increasingly high number of copy traders have had trades liquidated due to excessively high leverage. Generally speaking, setting a high leverage puts you at a much higher risk of experiencing liquidation and losing your margin.

Higher risk of liquidation and margin loss await if a higher leverage is set

Historical data shows that the main risks of high leverage are as follows:

Extreme fluctuations: A high leverage amplifies the impact of market fluctuations, which can result in much higher losses.

Risk of liquidation: When the market goes in an unfavorable direction, high-leverage trades are much more likely to liquidate, which will lead to loss of margin.

Accumulated losses: Over the long term, a high leverage can lead to an accumulation of losses, which will affect your long-term performance.

How do I decrease my leverage?

Option 1

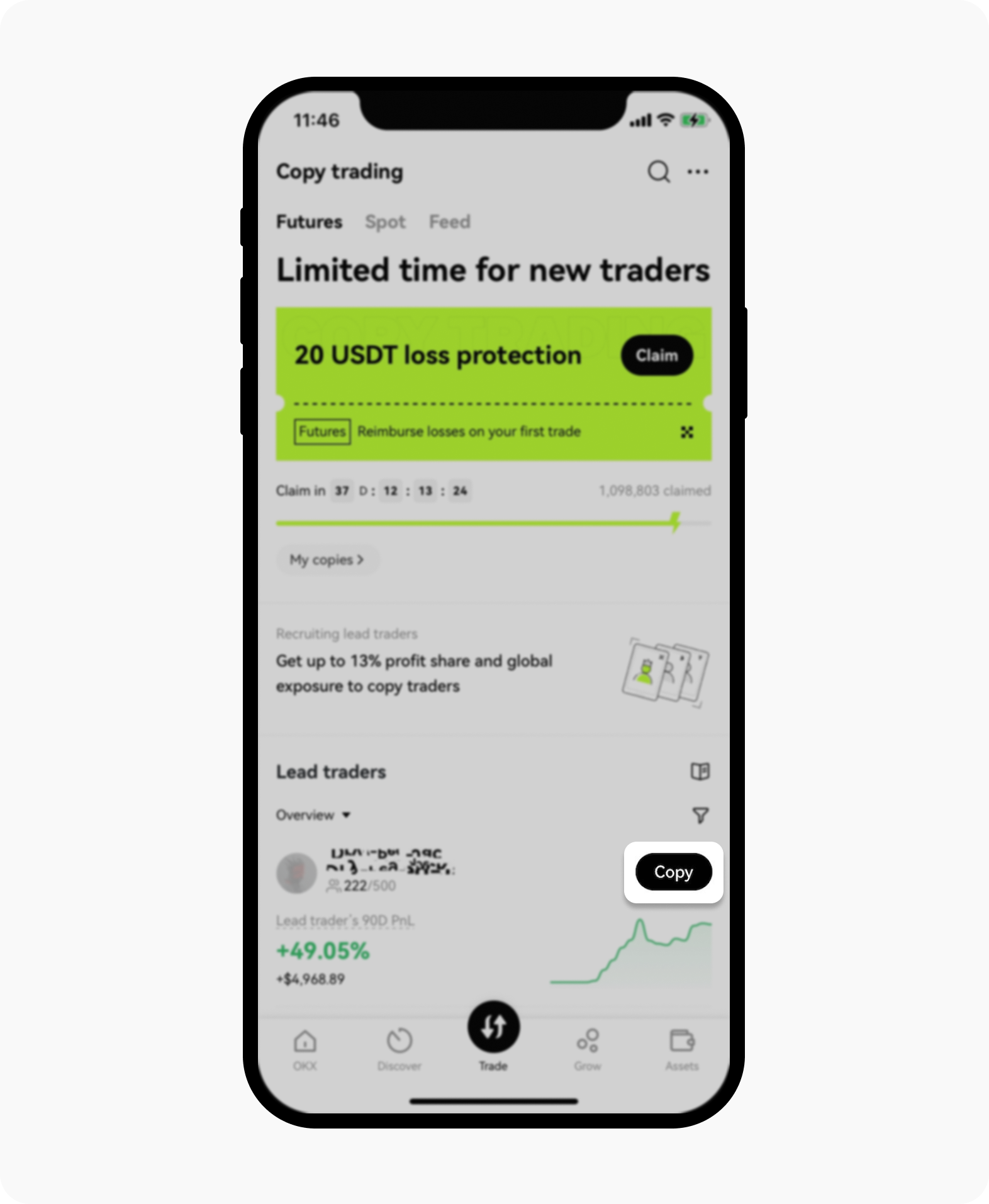

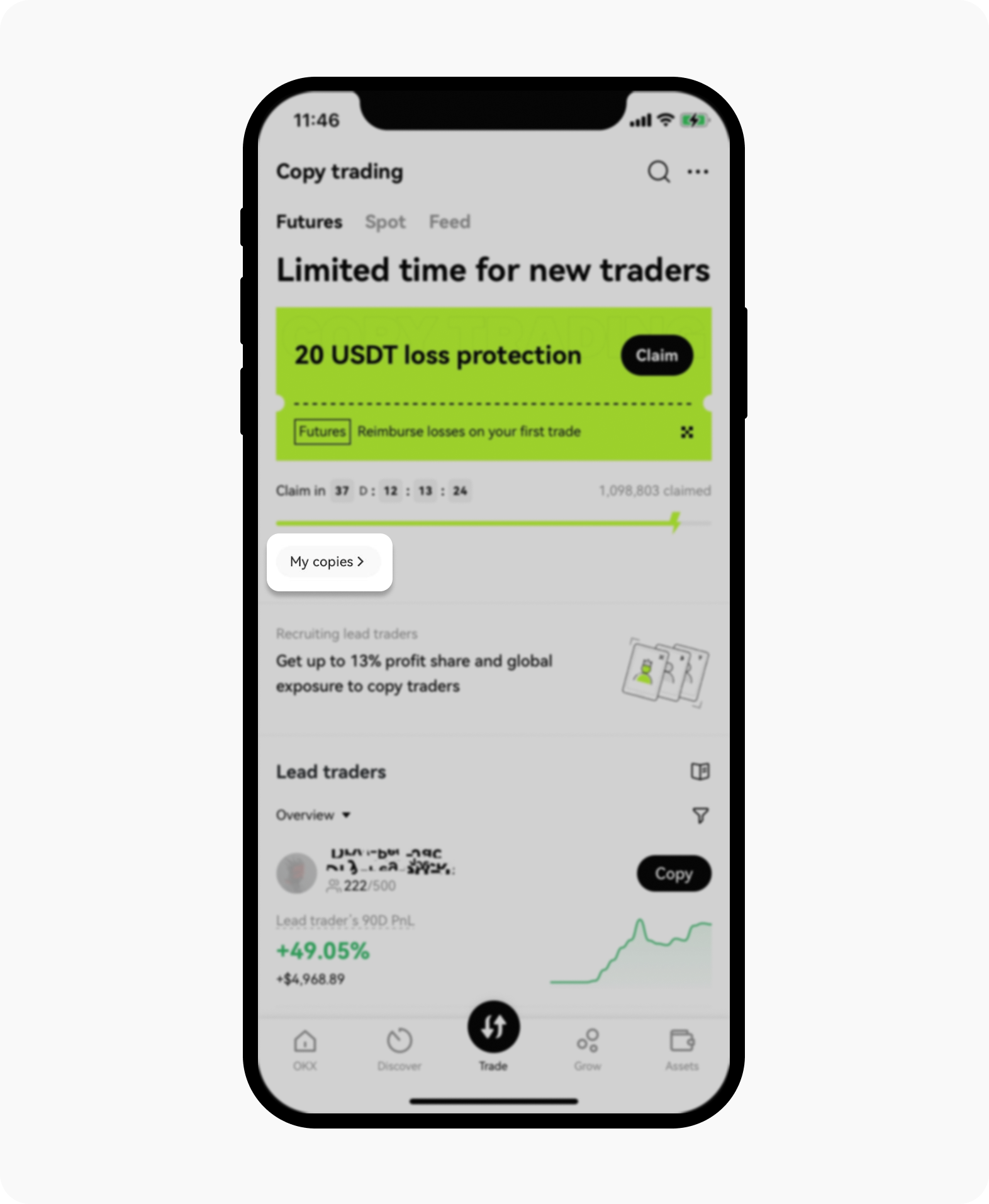

When creating a new trade, enter the Copy trading > Market board and select a trader to copy

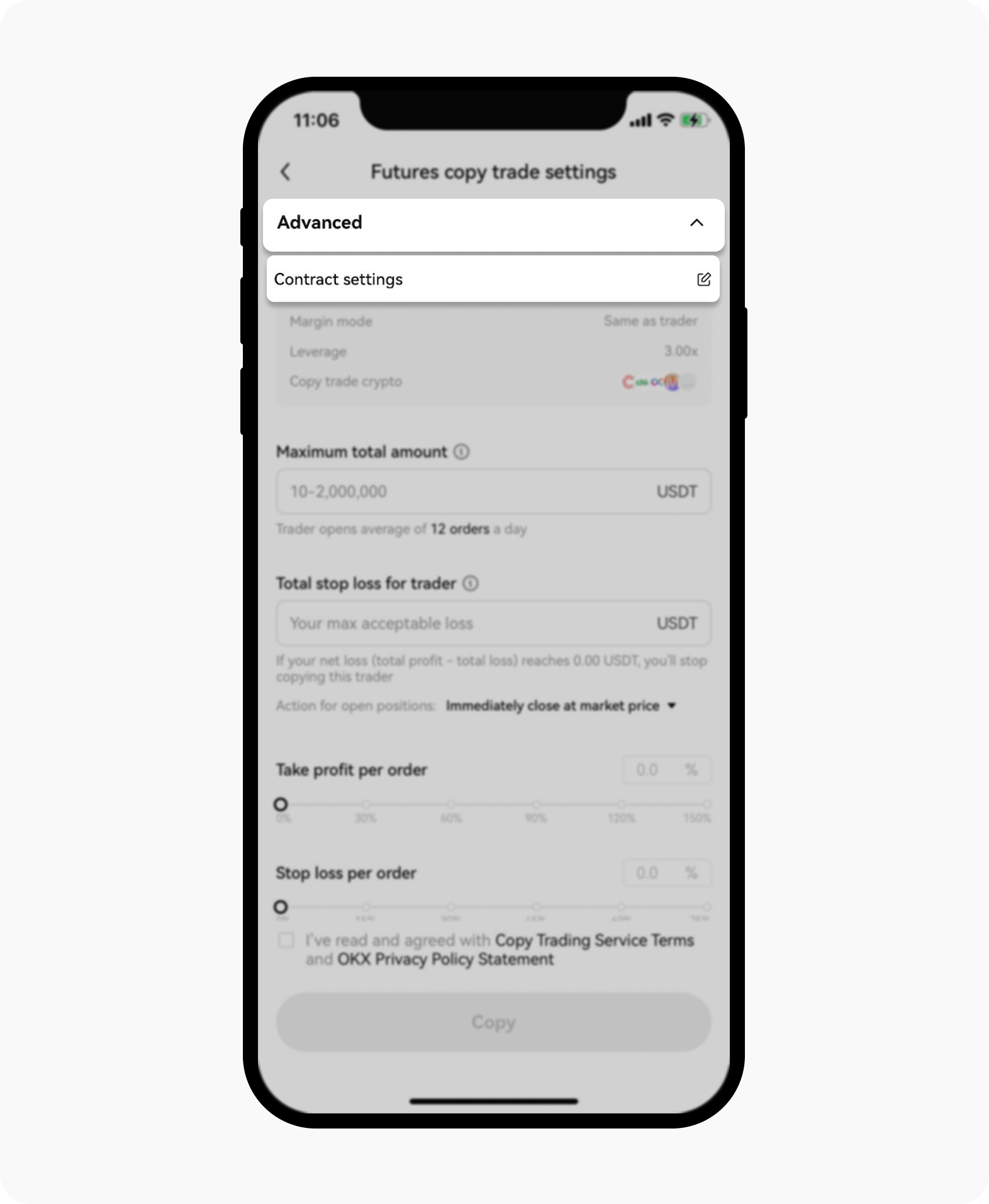

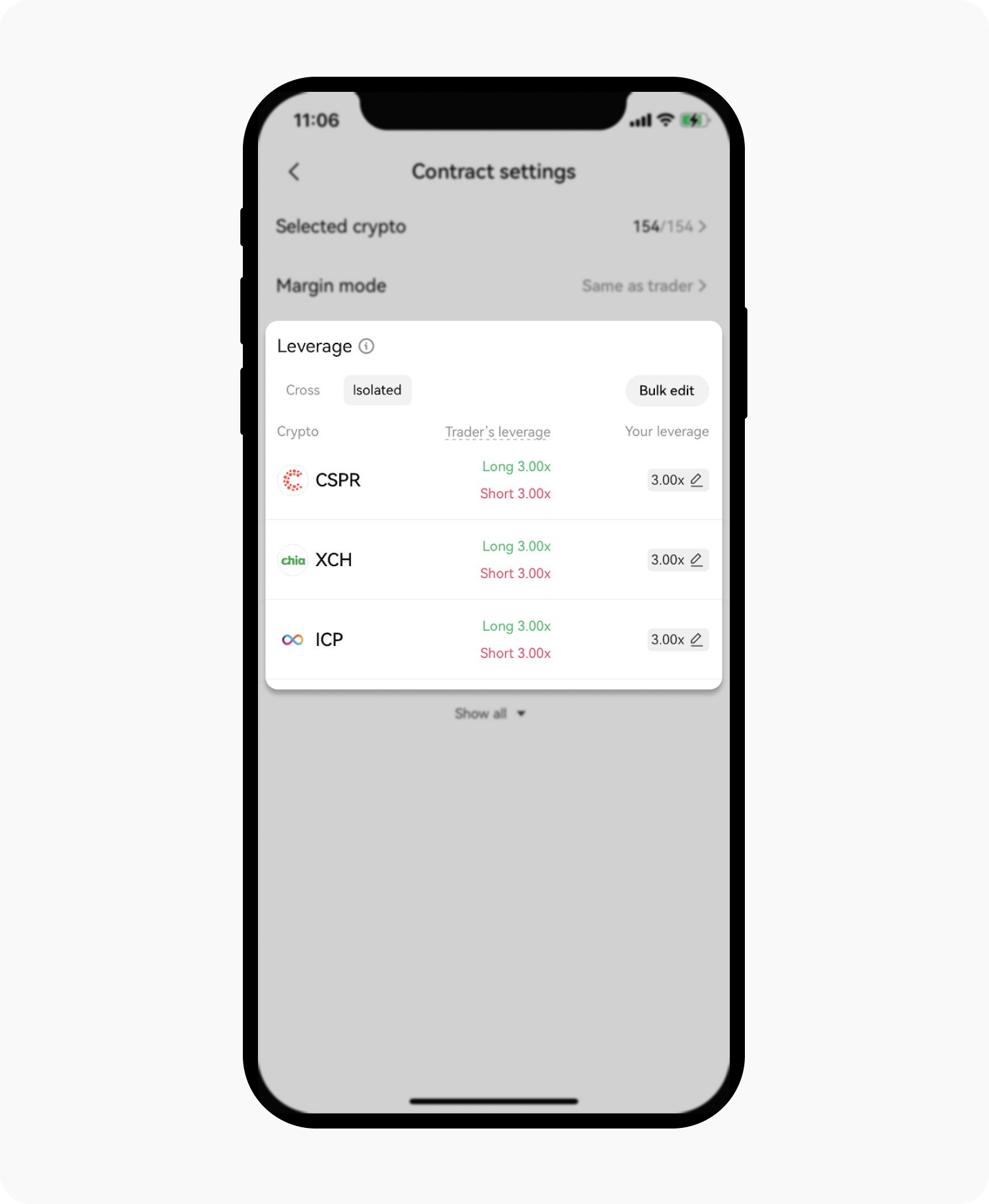

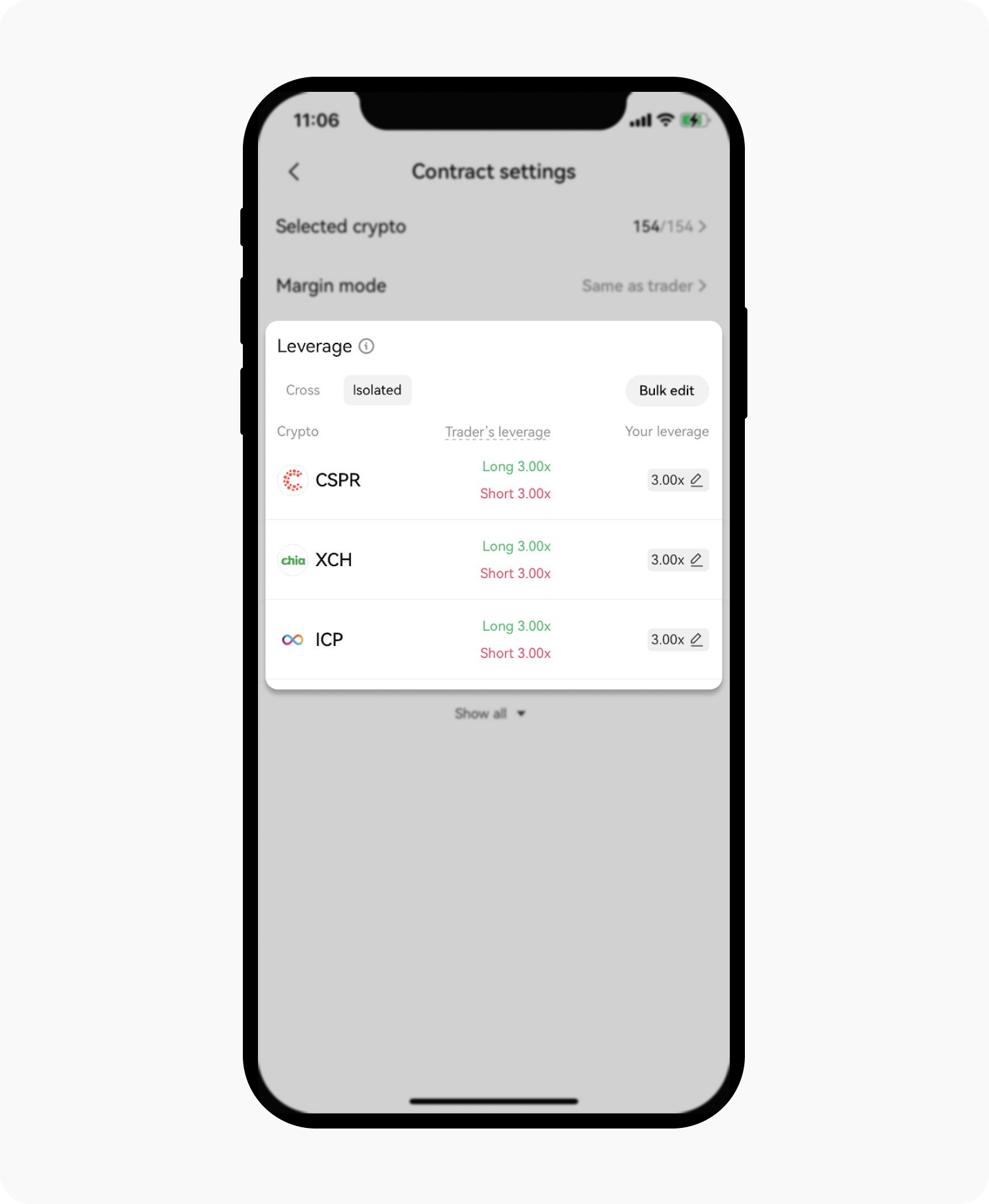

Select Copy now > Advanced settings > Contract settings > Leverage

Note: recommend setting the leverage for all futures to 20x or lower.

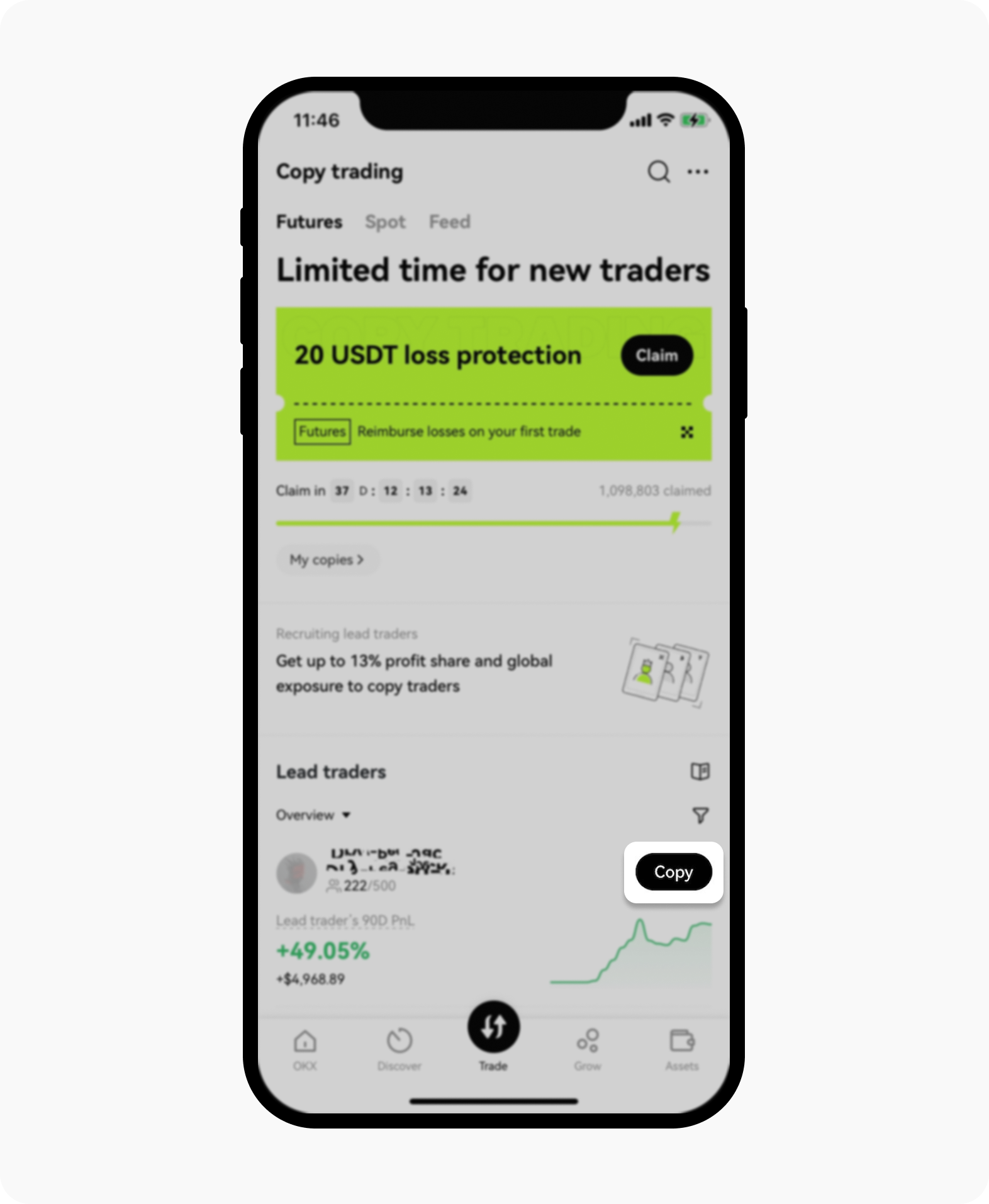

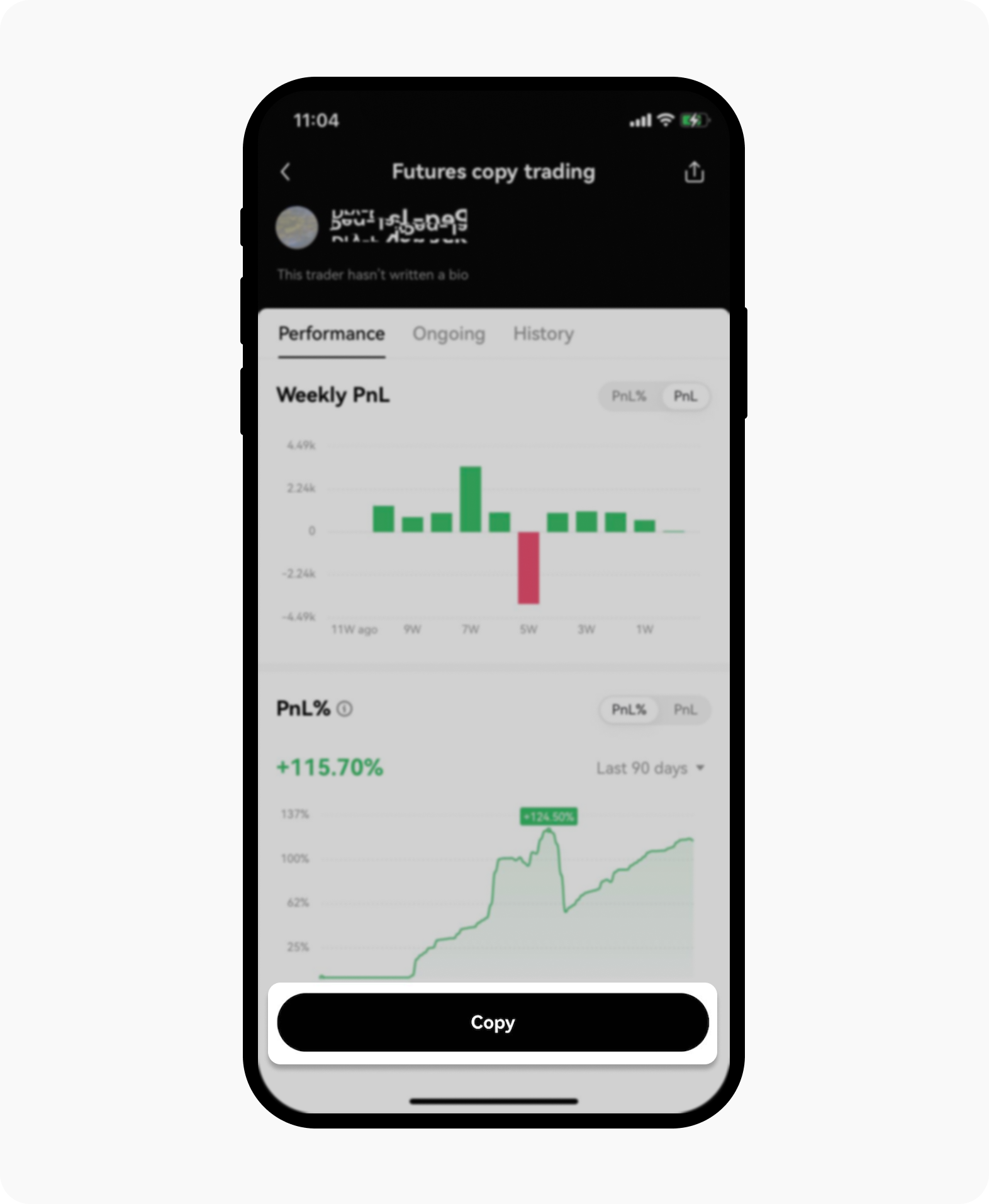

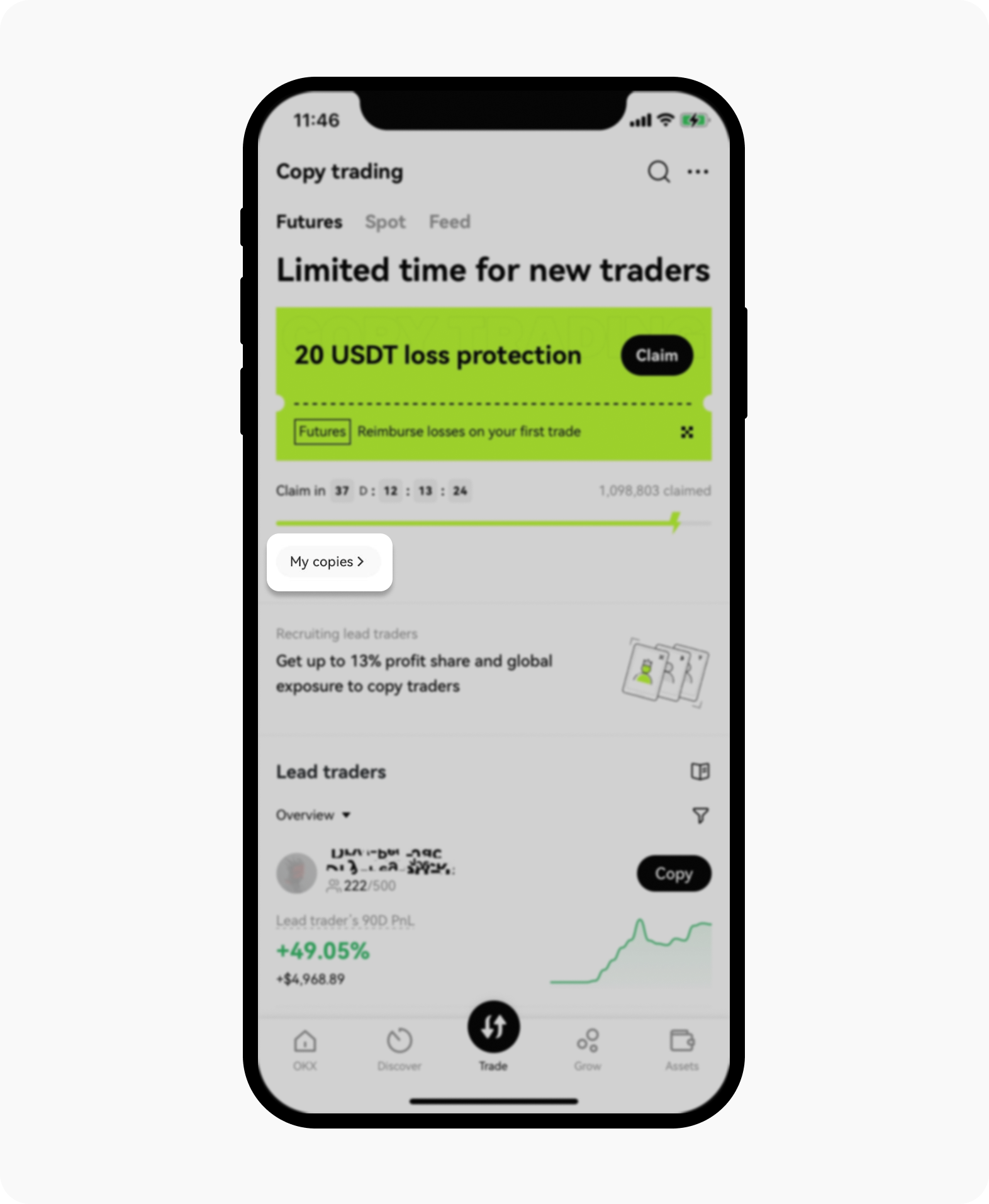

Select Copy on the Copy trading main page to kickstart the process

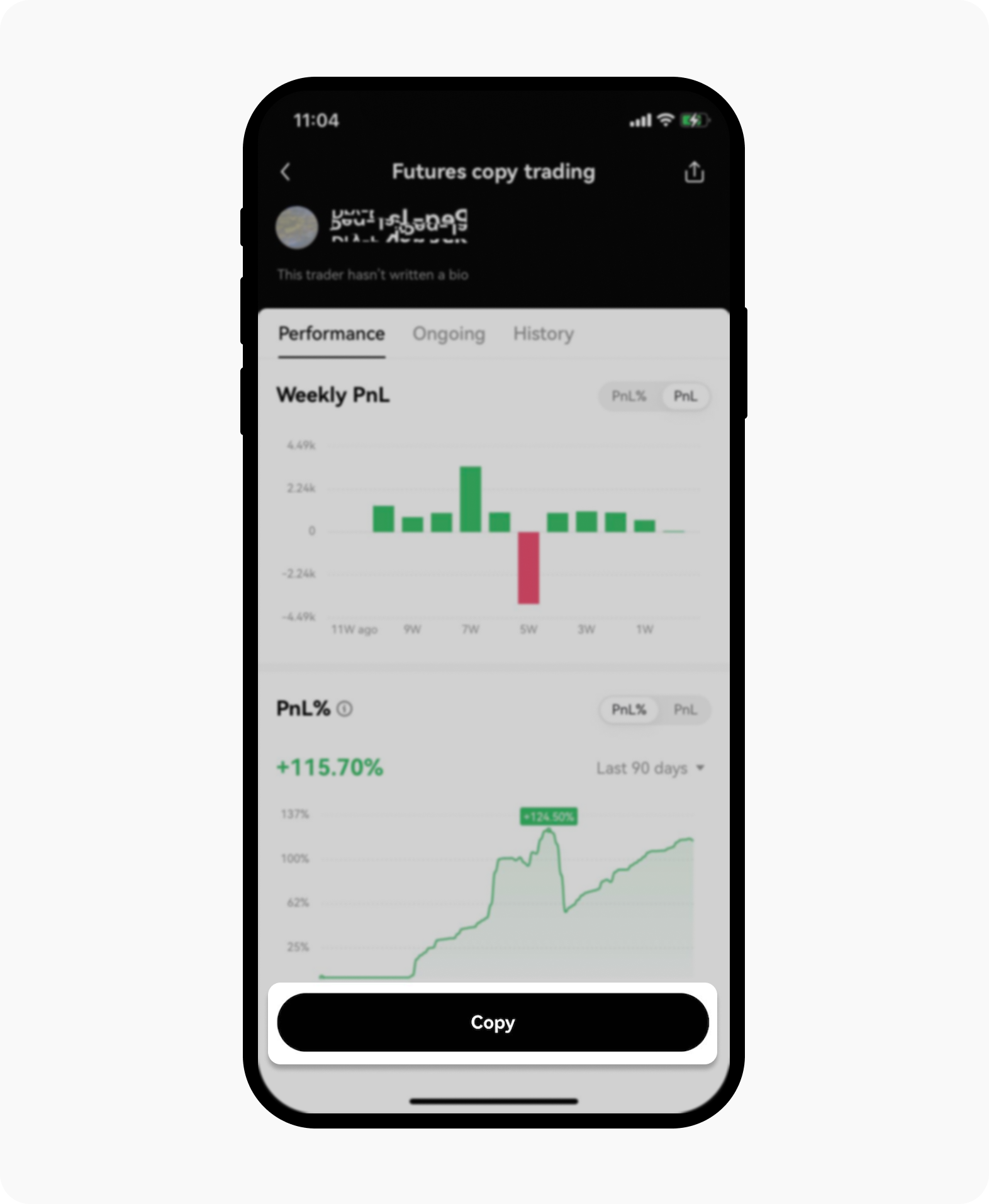

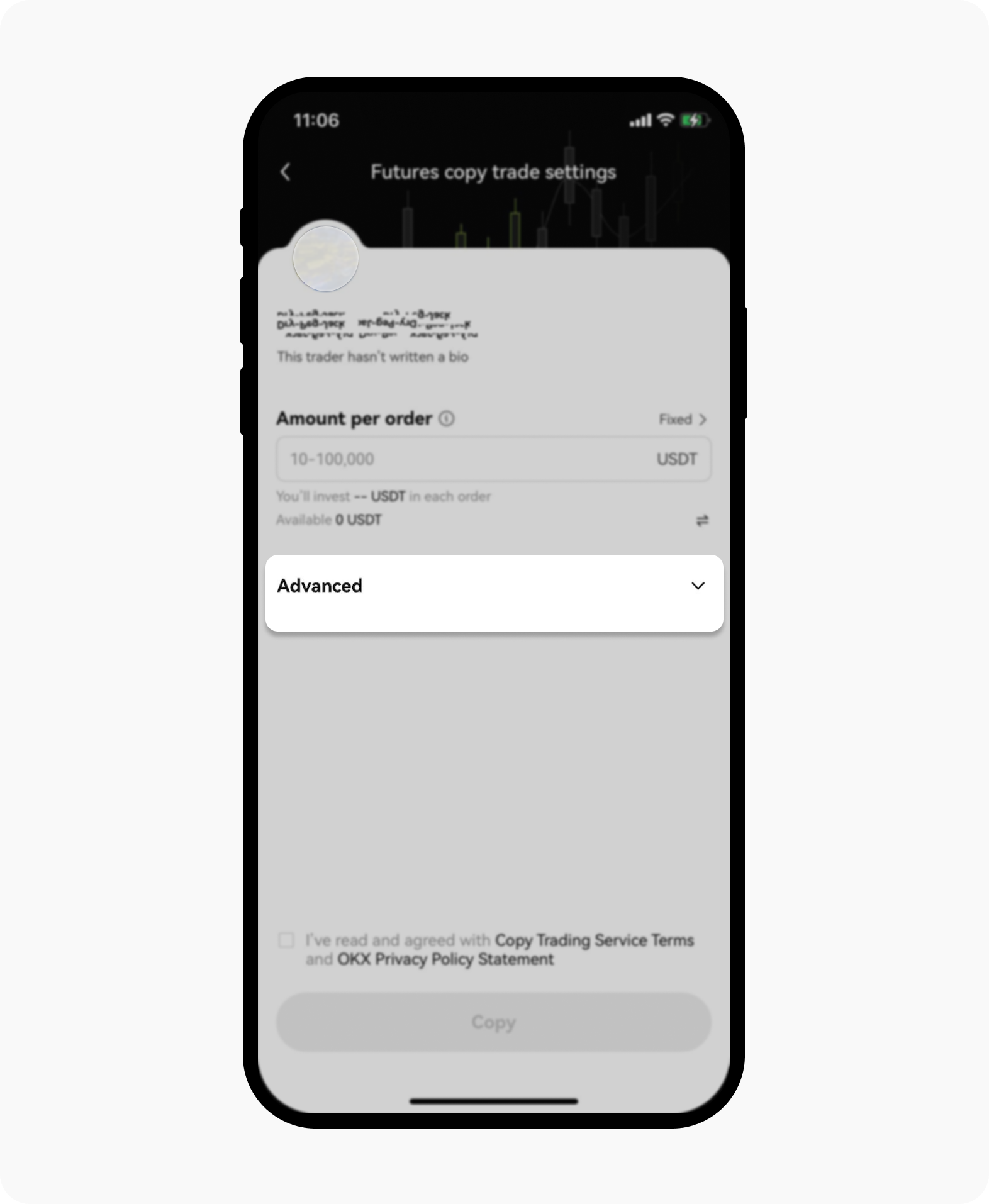

Select Copy to access the Advanced setting option

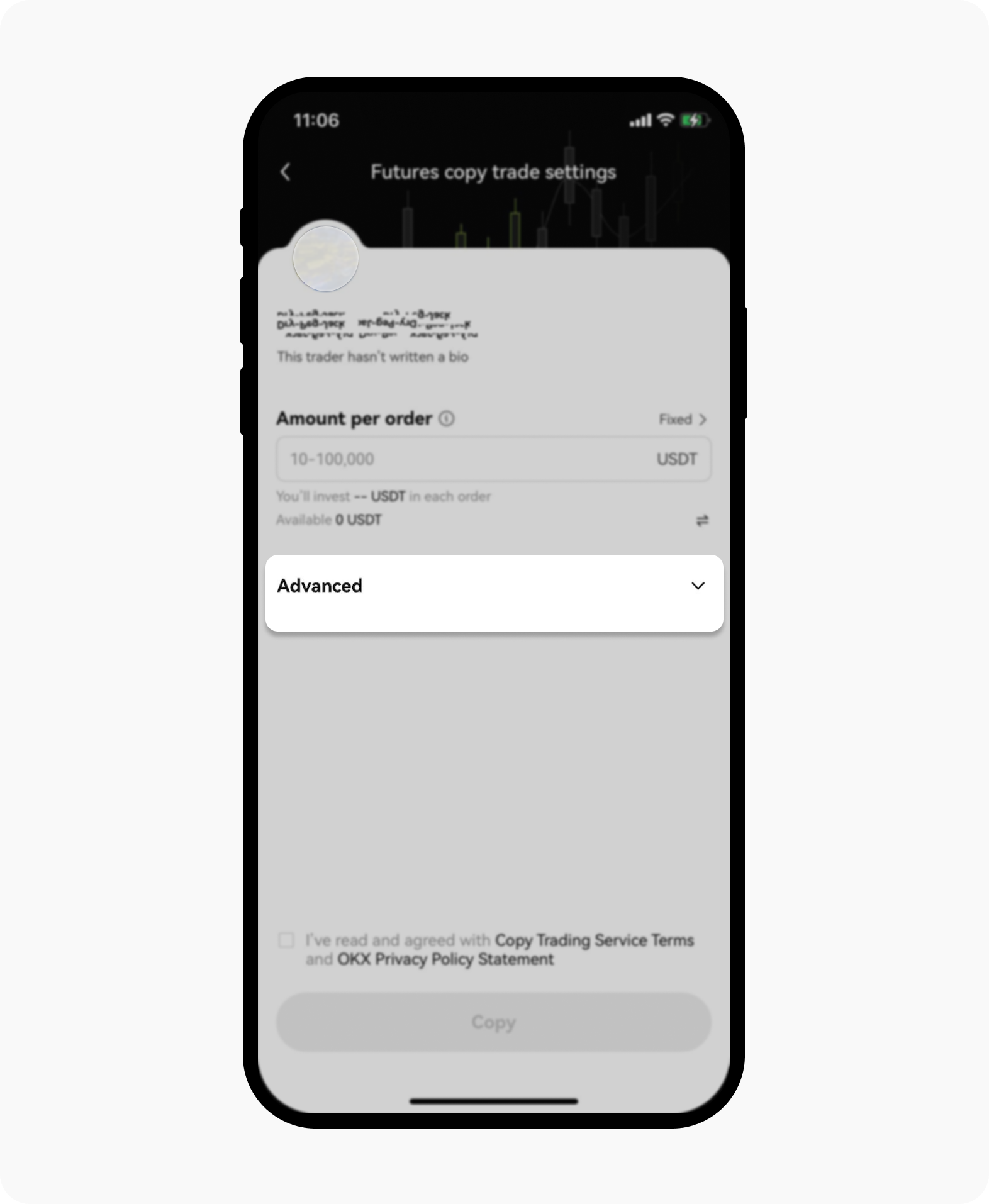

Select Advanced to view all the options for the settings

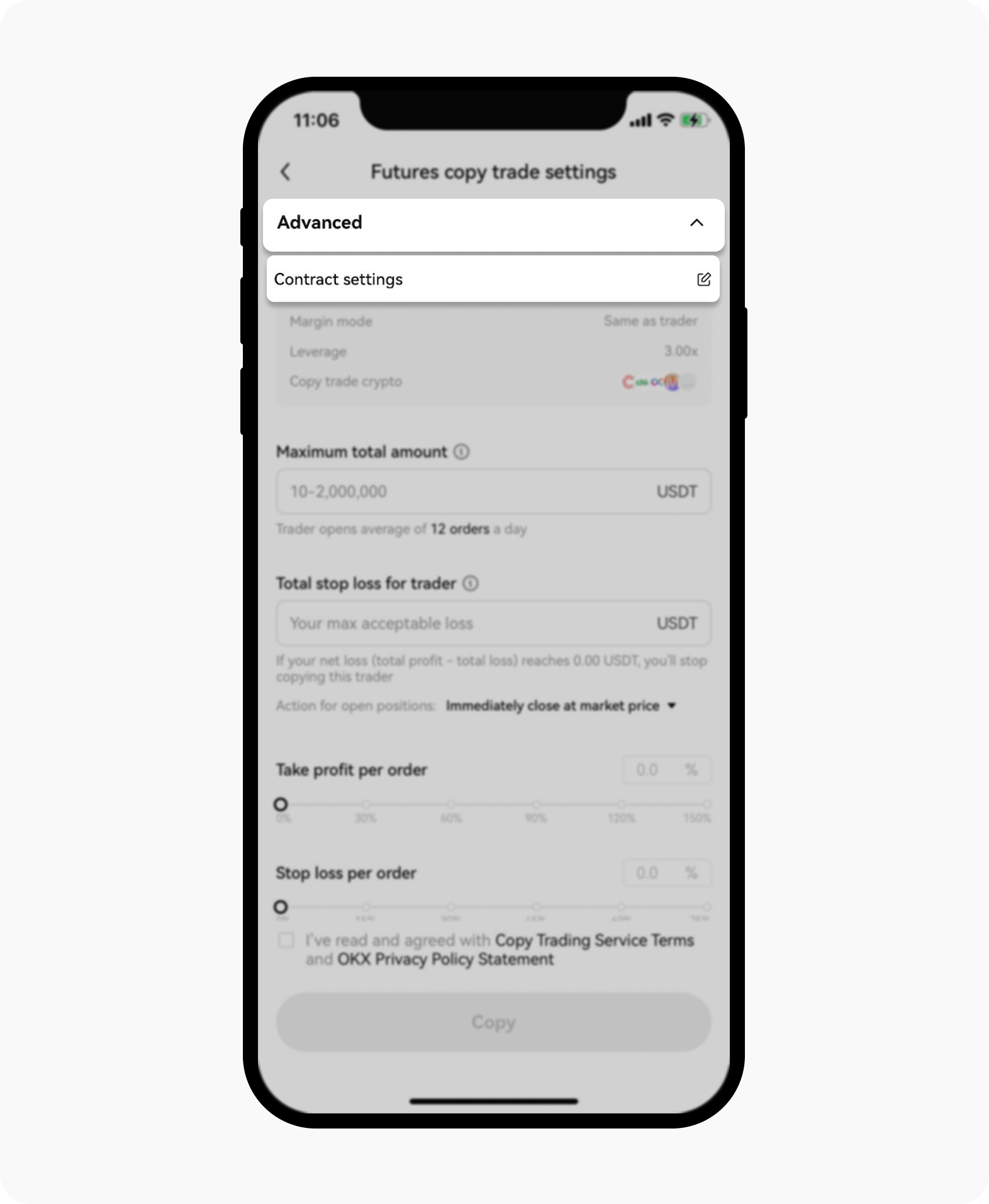

Select Advanced to enable the details of the Contract settings and select it to view the list of leverage

Make the changes as you wish at the Leverage section

Option 2

Enter Copy trading > Market board

Select My copies > My traders > Edit > Advanced settings > Futures settings > Leverage

Note: recommend setting the leverage for all futures to 20x or lower.

Select My copies on the Copy trading main page and follow the same steps as in the Option 1 process

Option 3

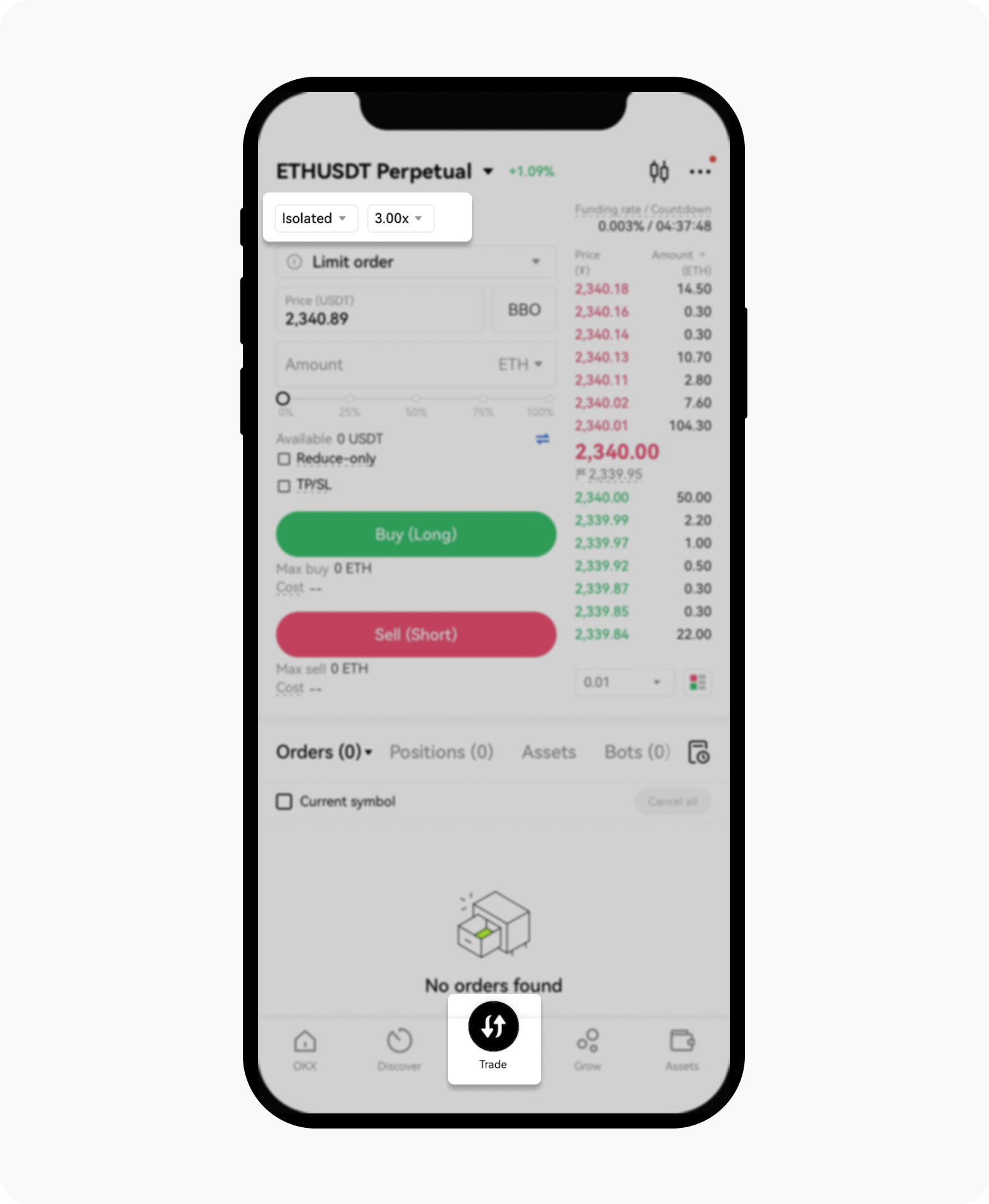

Set the leverage for each individual's futures on the manual trading page.

Note: recommend setting the leverage for all futures to 20x or lower.

Access the trading page via the Trade entry and revise your leverage accordingly at the Isolated option

What are the benefits of setting a low copy trading leverage?

Control risks: a low leverage can reduce potential losses and protect your assets from market fluctuations.

Decrease chance of liquidation: a lower leverage reduces the risk of liquidation, which can help stop you from losing all your margin.

Long-term profits: a lower leverage can help with your long-term investment planning. You'll need to spend less time watching the market for short-term changes, and your investments will be more robust and sustainable.

We strongly recommend you fully understand the relevant risks and market conditions before copy trading. Make sure to set a suitable leverage setting and avoid setting leverage above 20x.