How do I use Dual Investment?

What are Structured Products?

Structured products are innovative financial instruments that earn interest from the derivative market. You can choose products based on current market trends and your risk appetite that cater to your investment needs.

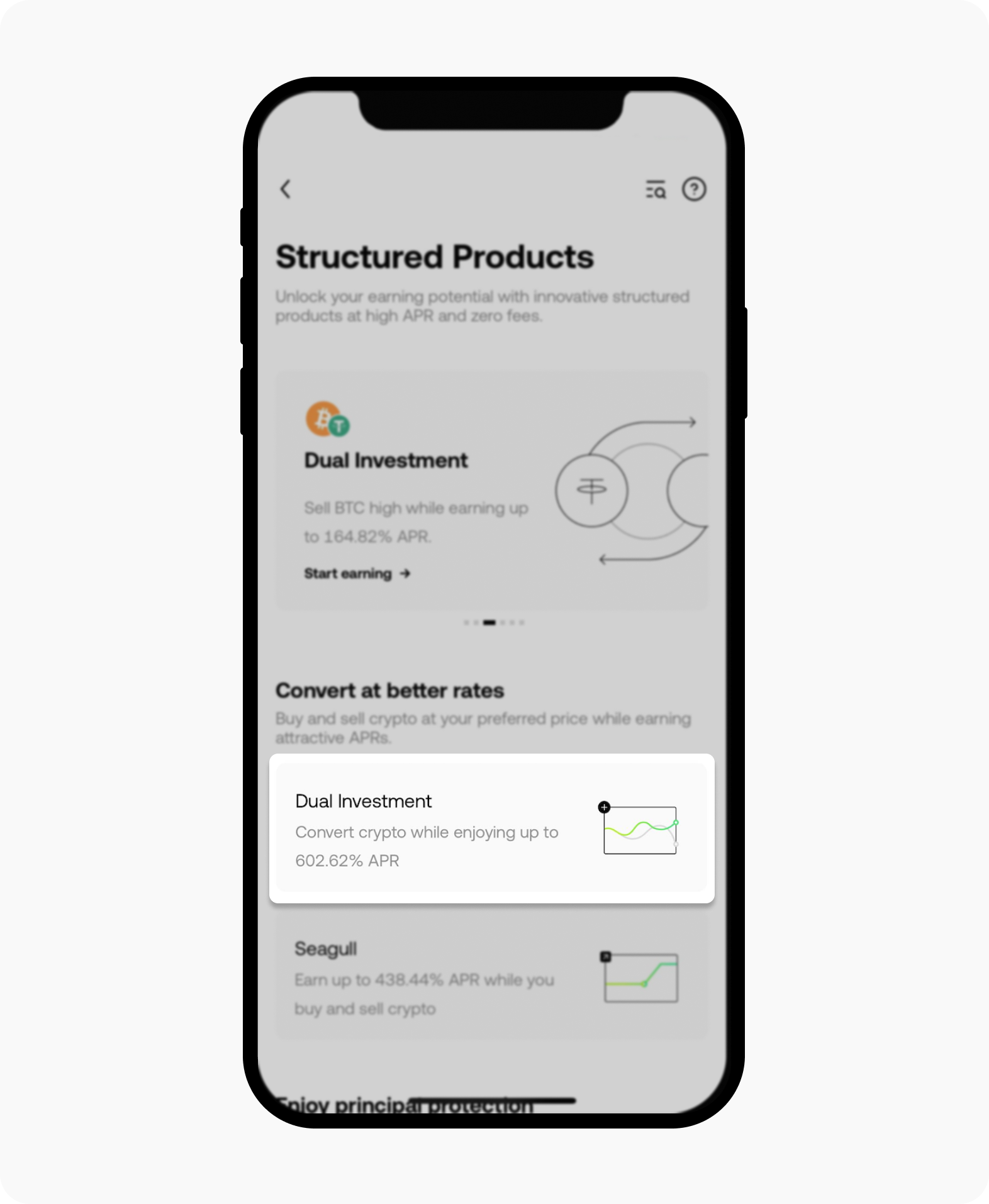

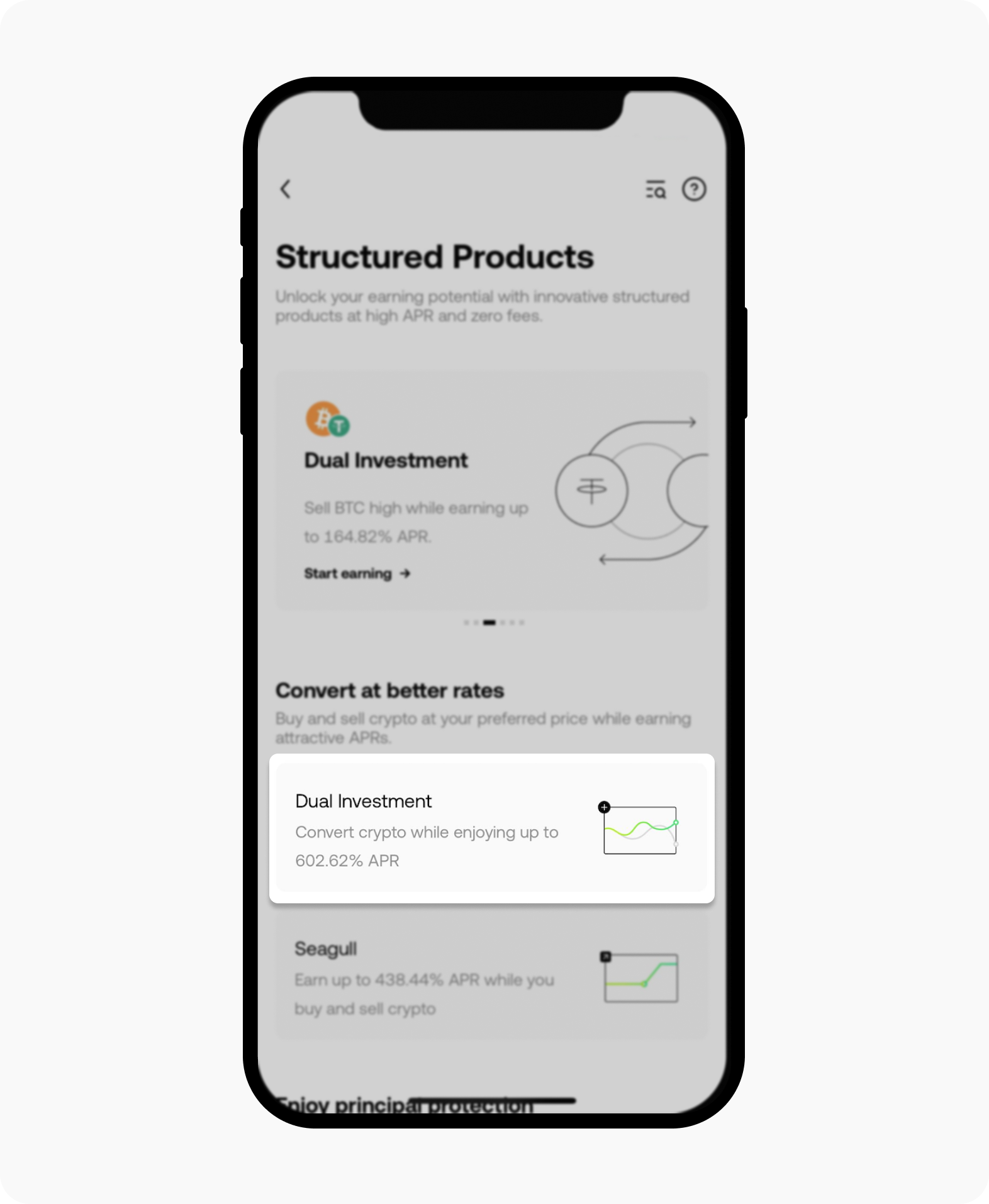

There are 3 products introduced in Structured Products:

Shark Fin: gain USDT in any market condition with principal protection.

Dual Investment: buy and sell crypto at your target price, and earn high returns at the same time.

Dual Investment Lite: simplified yield-enhancement with flexible target prices and lower risks.

How do I use Dual Investment?

On the app

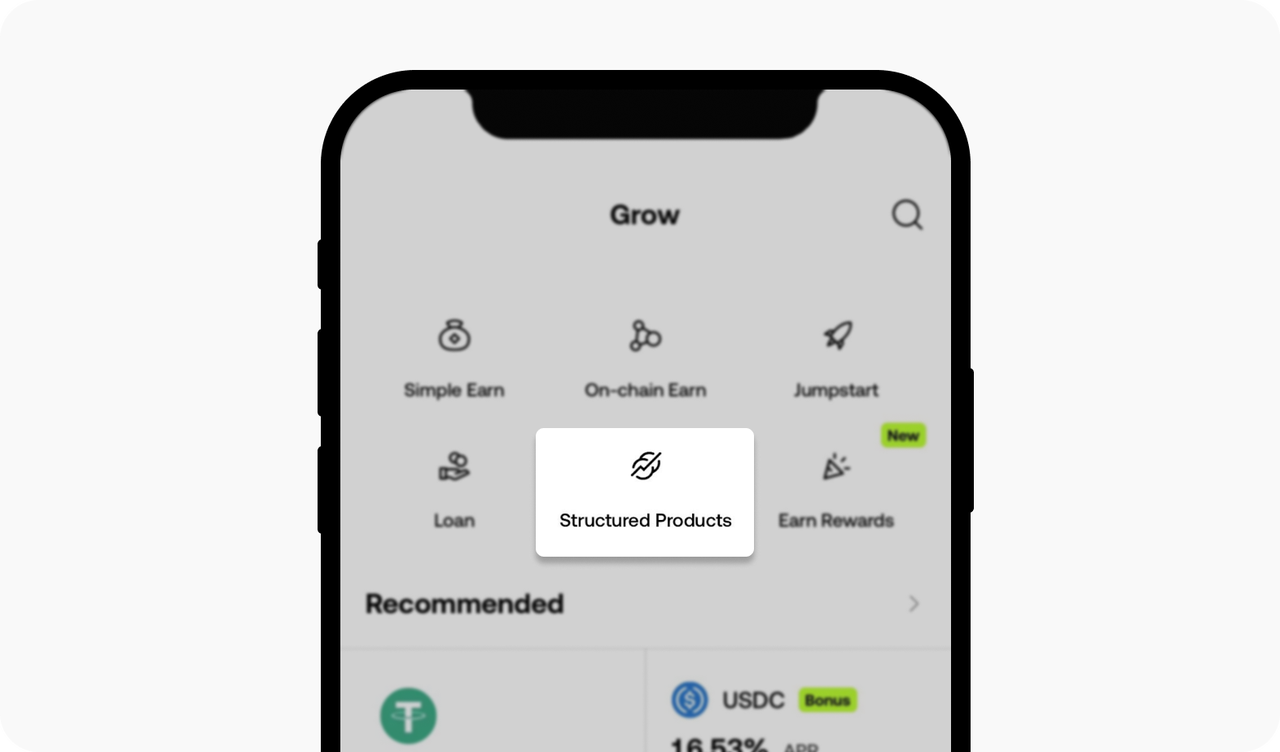

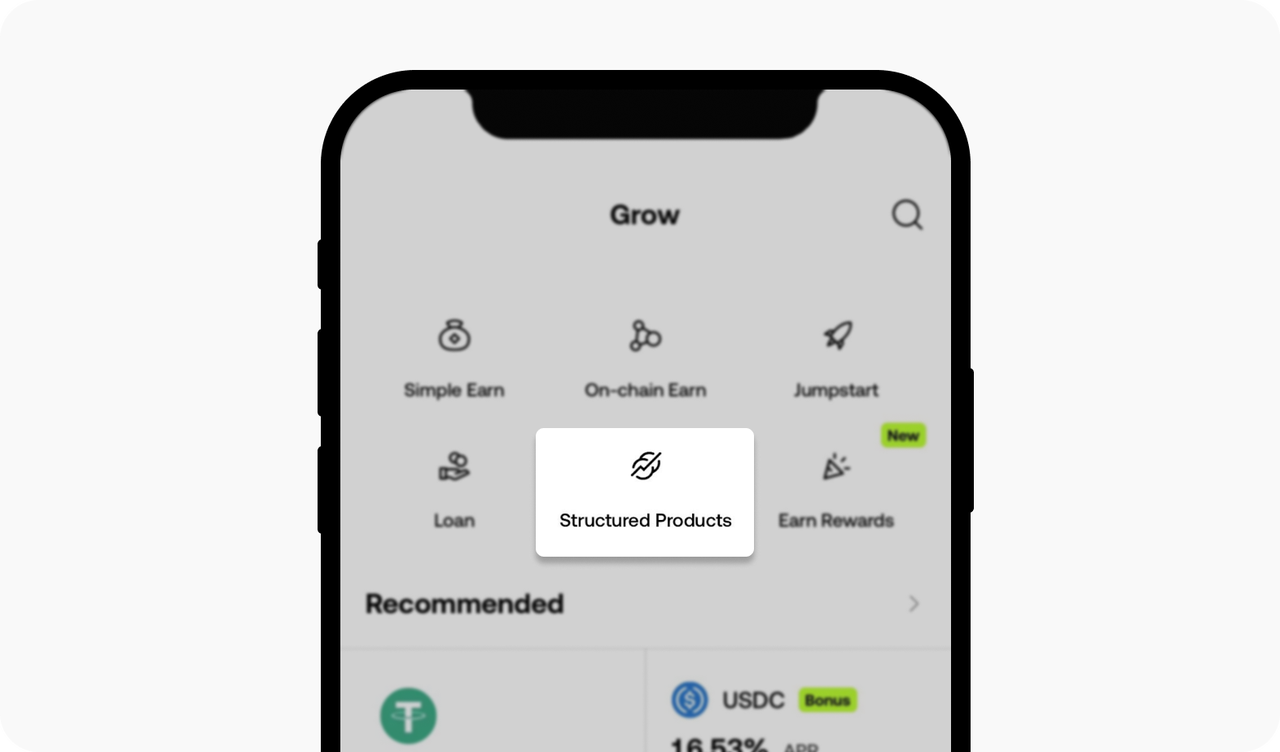

Open the OKX app, go to Grow, and select Structured Products

Load Structured Product page

Find the Dual Investment section

Open Dual Investment page

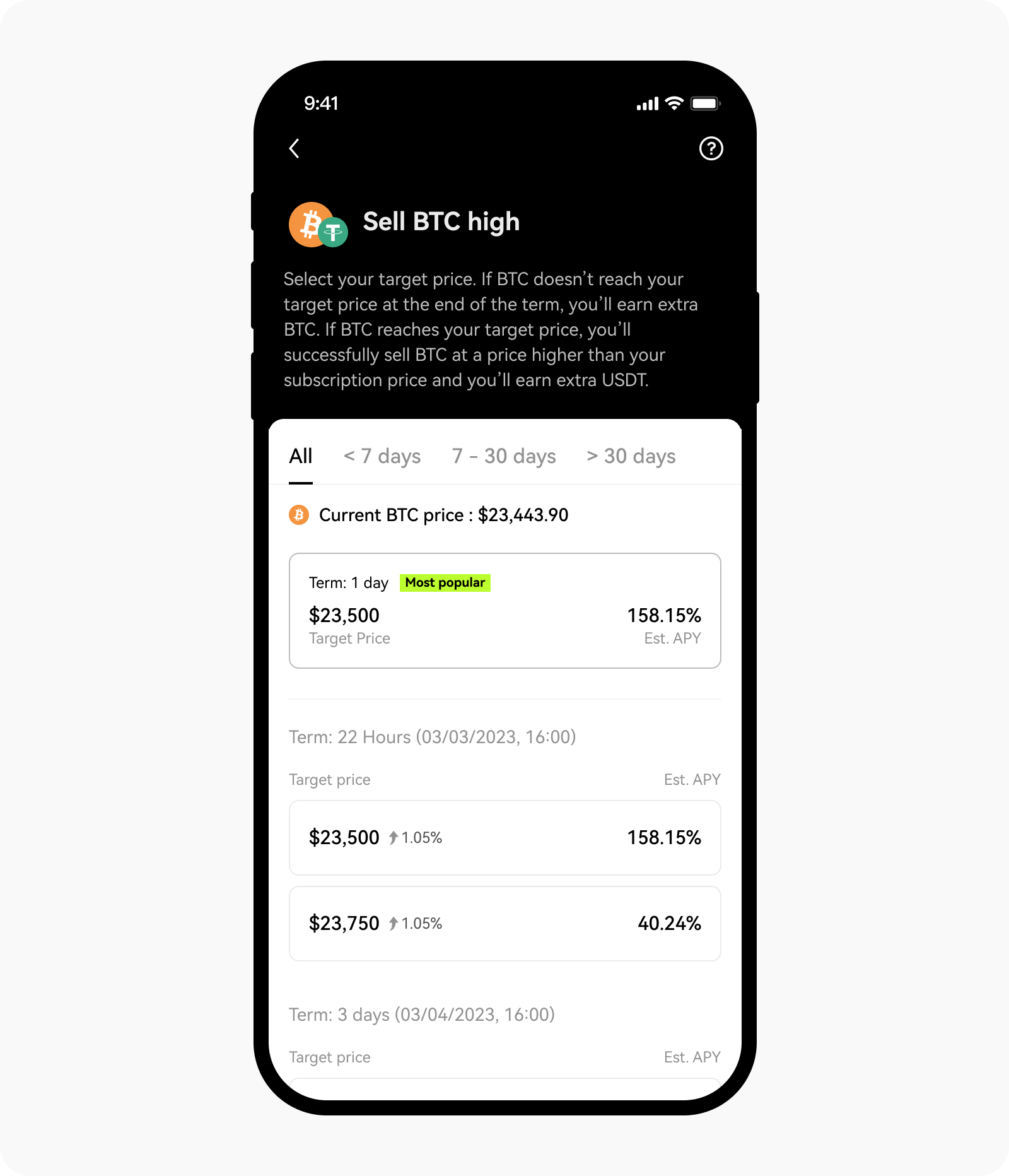

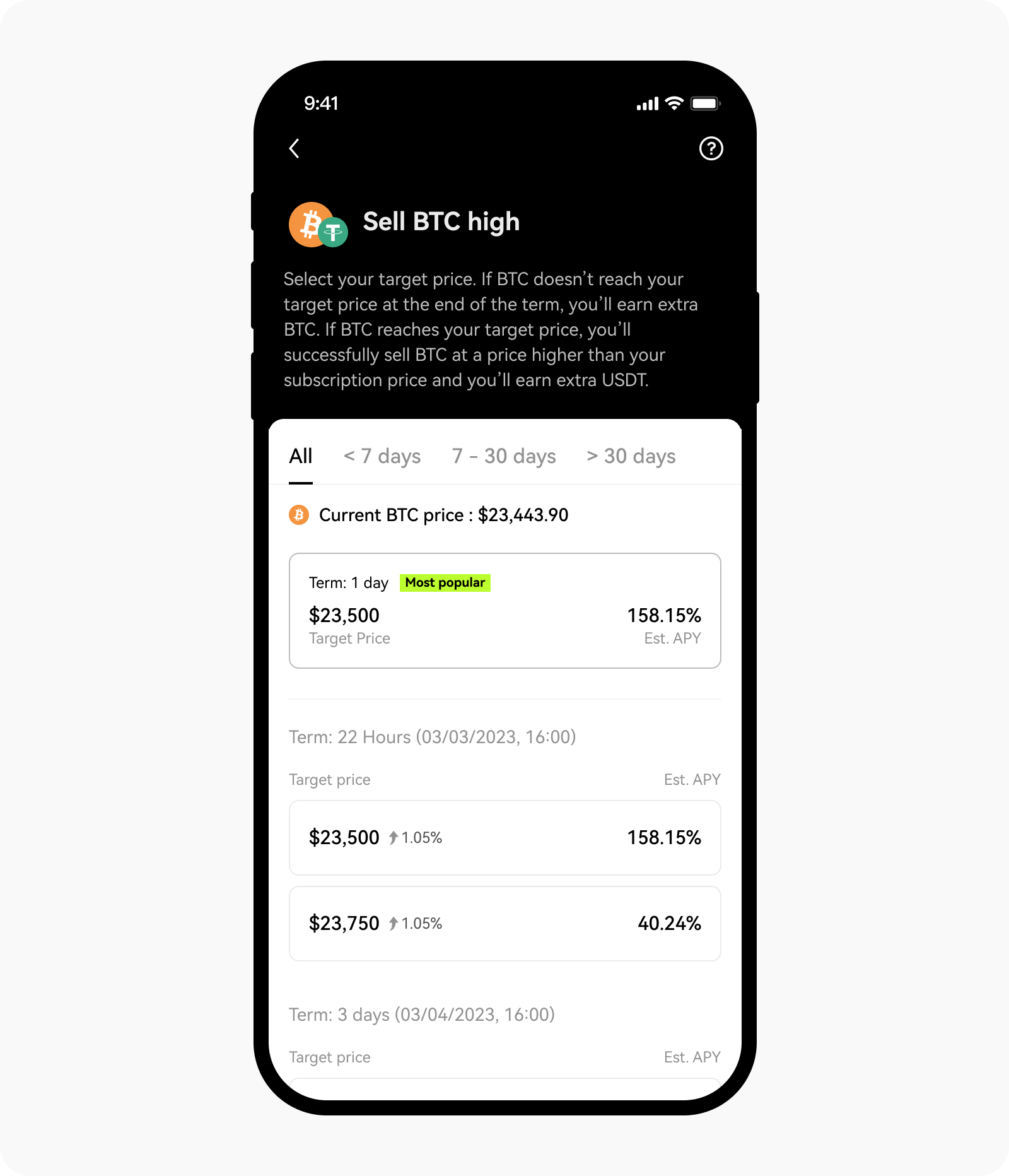

Select your preferred crypto, and choose between the two options available

Select your preferred options for crypto

Select your preferred options according to the available Term and Target price

Select your preferred option to subscribe

Insert your preferred amount in the Subscription Amount field and select Confirm

Read through the order summary, select the dual investment user agreement checkbox, and Confirm to complete the request

On the web

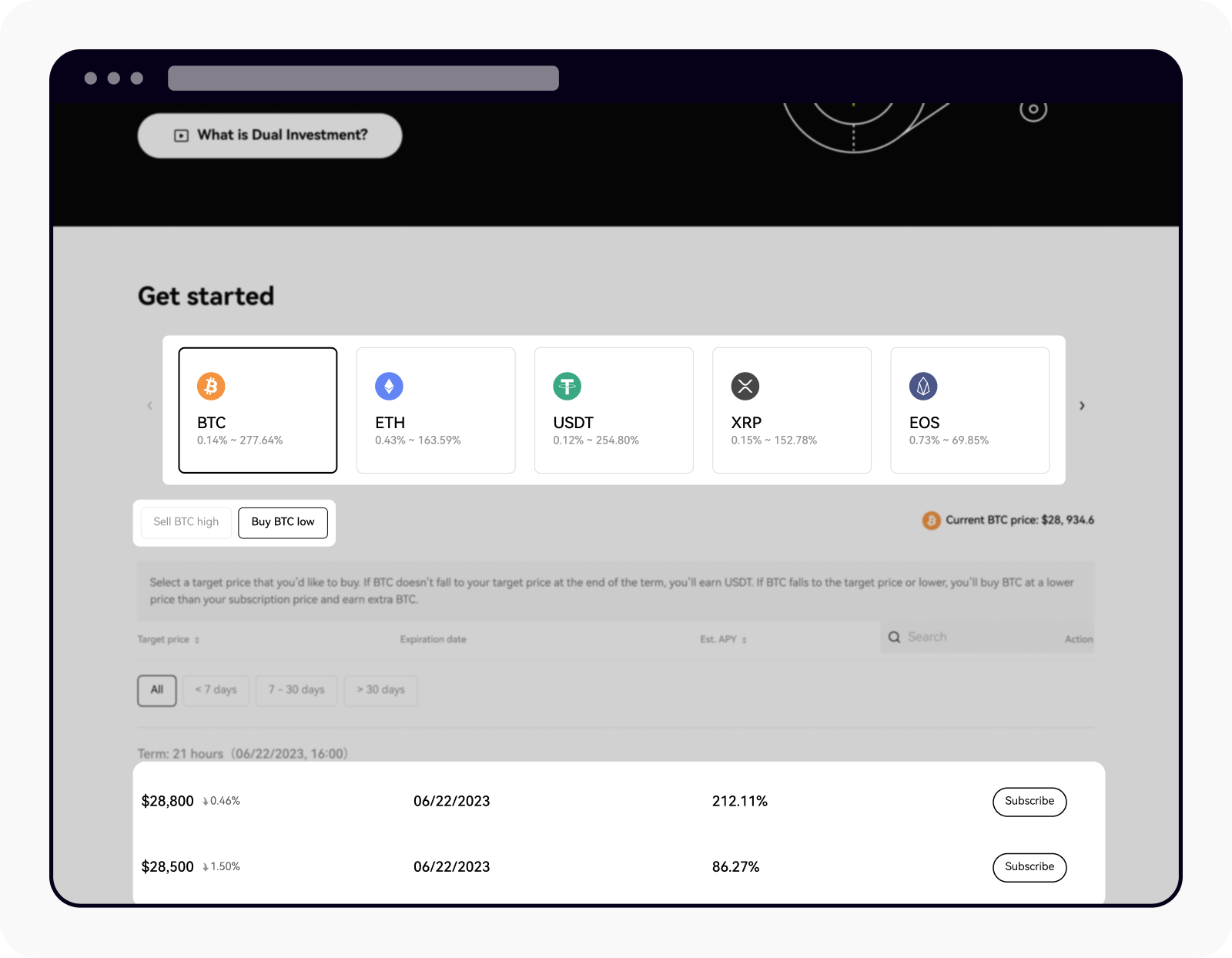

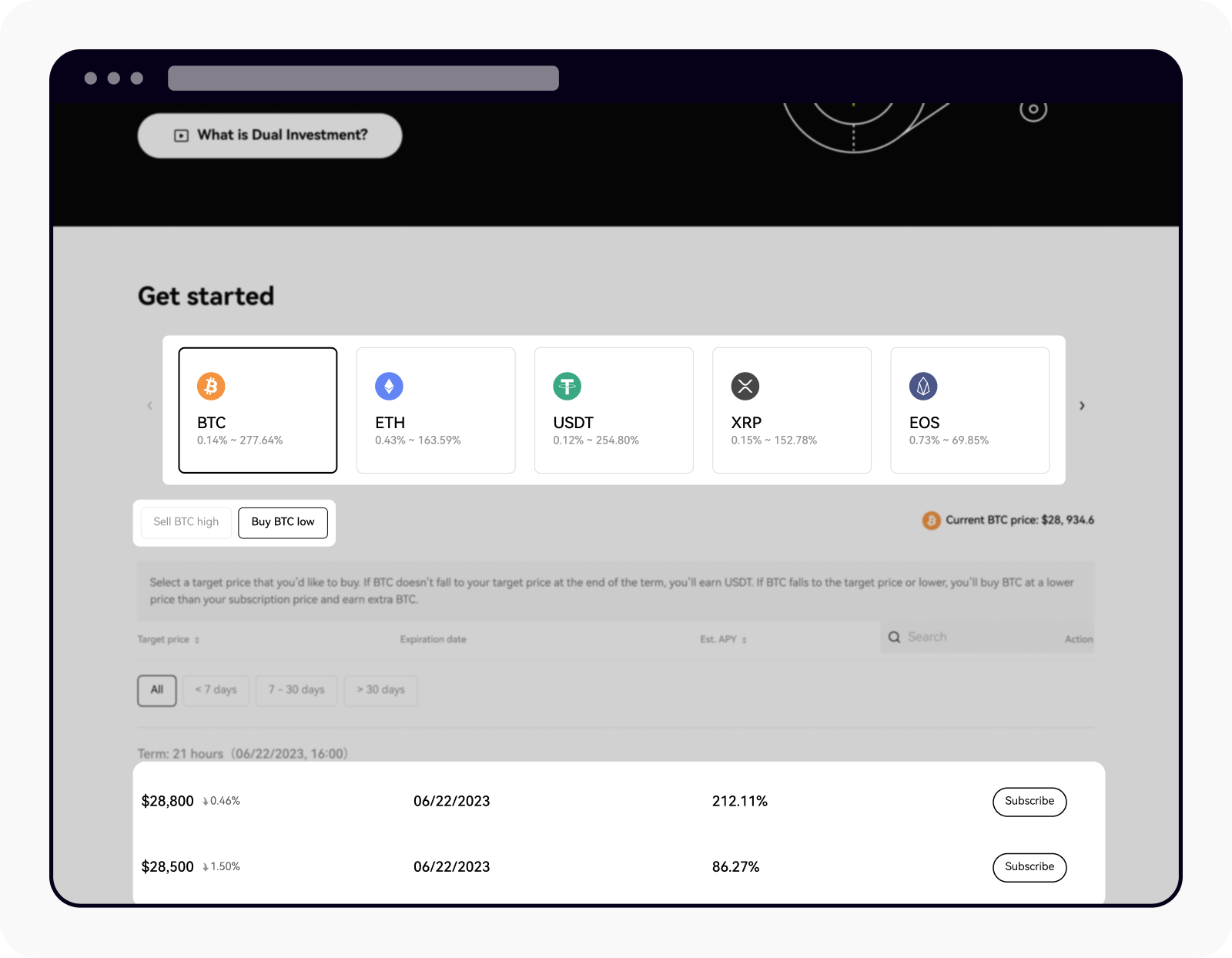

Log in to your account at okx.com and go to Grow > Earn > Structured Products > Dual Investment

Select your preferred crypto and select either the Sell or Buy option

Find your preferred options according to the available Term and Target price, and select Subscribe

Select your preferred crypto and product option to subscribe

Insert your preferred amount in the Subscription Amount field and select Continue

Read through the order summary, select the dual investment user agreement checkbox, and Continue to complete the request

FAQ

1. Do I need to hold USDT/USDC to subscribe to ETH/BTC pair?

No, you don't have to.

2. Can I redeem before the expiration date?

No. Early redemption isn't available for ETH/BTC.

3. When can I redeem my order?

The order can be redeemed 24 hours after the interest started to accrue, and no later than 24 hours before the expiration time.

Take for example, an order with the following details:

Interest accrual time: 03/01/2022, 08:00 UTC

Expiration time: 03/11/2022, 08:00 UTC

Then, the order can be redeemed at any time between:

Start time: 03/02/2022, 08:00 UTC

End time: 03/10/2022 08:00 UTC

4. When will my returns be credited to my Funding account?

If your redemption is successful, your crypto will be credited to your Funding account the following day at 10:00 UTC.

5. Does early redemption incur a loss?

If you choose to redeem early, you'll be able to review the exact amount of crypto you'll receive. Redeeming early may lead to losses, as the amount could be less than the initial subscription amount.

Choosing early redemption also means you'll only receive the crypto that you used to invest. For example, if you invested BTC, you'll only be able to redeem BTC and won't have the choice of redeeming in USDT.

6. How will I receive the rewards?

Generally, your earnings will be automatically credited to your funding account at 10:00 UTC on the expiration date. Under certain circumstances, the settlement might be delayed by up to 24 hours.