INJ

Injective price

$9.4720

-$0.42900

(-4.34%)

Price change for the last 24 hours

How are you feeling about INJ today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Injective market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$928.41M

Circulating supply

97,727,220 INJ

97.72% of

100,000,000 INJ

Market cap ranking

53

Audits

Last audit: Sep 1, 2020

24h high

$9.9690

24h low

$9.1660

All-time high

$53.2000

-82.20% (-$43.7280)

Last updated: Mar 14, 2024

All-time low

$6.3420

+49.35% (+$3.1300)

Last updated: Apr 7, 2025

Injective Feed

The following content is sourced from .

Injective 🥷

Discover how $INJ is transforming the crypto landscape with dynamic supply mechanisms and a revolutionary token burn system.

Here are some key highlights from Injective’s comprehensive paper on INJ’s groundbreaking tokenomics.

1⃣ Introduction

INJ, the native asset of Injective, is revolutionizing tokenomics with dynamic supply mechanisms and a strategic token burn system. “INJ: A Programmable Token Economy for Deflationary Acceleration” is a comprehensive paper that dives deep into INJ’s economic design, exploring its utilities, supply mechanics, and token burn system. Most notably, the paper illustrates how the recent INJ 3.0 upgrade significantly enhances the token economic design, driving deflationary acceleration and propelling a thriving Web3 ecosystem.

This post breaks down the paper's key points, providing a snapshot of how INJ stands out in the crypto landscape. Discover the highlights here, and delve into the full paper for an in-depth understanding of INJ's impact on the Injective ecosystem and decentralized finance.

2⃣ What is INJ?

INJ serves as the native asset of Injective, facilitating various operations within the network. It acts as the default asset to facilitate the purchase and sale of goods and services between parties on the blockchain (transaction fees, buying/selling NFTs, collateral, etc.). Additionally, INJ secures the network through staking, where validators and delegators earn rewards in return for maintaining network security and producing blocks. Lastly, INJ is utilized for community-led governance across all parameters of the chain, allowing for a decentralized environment in which all stakers have a voice in the evolution of Injective.

3⃣ Mechanics of INJ

🪐 Supply Dynamics

Injective leverages its mint module to dynamically adjust supply parameters based on the network’s bonded-stake ratio. This mechanism, known as the Moving Change Rate Mechanism, is designed to engineer network activity that is responsive and adaptable, ensuring that the supply aligns with demand and network security needs. When more INJ is minted per block as the block reward, participants are incentivized to stake more INJ to benefit from increased rewards. Conversely, when the block reward decreases, stakers are incentivized to unbond staked INJ due to decreased rewards. This adaptive framework enables programmatic control based on objective economic indicators as inputs, promoting a balanced and stable network by constantly adjusting supply rates to meet staking targets.

🔥 Deflationary Mechanism

Injective employs a novel Burn Auction system to reduce the total supply of INJ. This deflationary mechanism operates through weekly auctions where participants bid on a basket of tokens using INJ. The highest bid wins the basket, and the winning bid amount of INJ is burned, effectively reducing the supply. The Burn Auction is powered by the exchange and auction modules. The exchange module facilitates shared liquidity across the network, generating revenue from transaction fees and other activities. The exchange module revenue share is structured to allocate 60% of revenue to the Burn Auction, with the remaining 40% retained by applications. Recent Burn Auction upgrades expanded this, allowing universal participation and uncapped contribution percentages from dApps. The auction module manages the entire process, from collecting tokens to coordinating bids and burning the winning INJ amount. This system not only supports deflation but also incentivizes active participation within the ecosystem.

🏹 Dynamic Economic Architecture

The synergy between dynamic supply adjustments and the Burn Auction creates a robust economic architecture for INJ. The mint module’s ability to adjust supply rates in real-time, combined with the regular burning of INJ through auctions, ensures a controlled and deflationary token supply. This architecture fosters economic stability by balancing supply and demand while promoting long-term network security and value appreciation. As the ecosystem grows, the Burn Auction's impact scales, continually reinforcing the deflationary nature of INJ and supporting sustainable network growth, i.e., Deflationary Acceleration.

4⃣ Notable INJ Events

Completion of Genesis Supply Unlock

The INJ token generation event (TGE) occurred on October 21, 2020. The completion of the vesting schedule in January 2024 marked a significant milestone in INJ’s lifecycle, ensuring that all planned allocations were distributed according to the predefined schedule. This full unlock allowed for the creation of a truly decentralized ecosystem in which network participation is fully open and accessible to all.

🏁 Burn Auction Milestones

Enhancements to the Burn Auction allowed any application and individual users to participate, expanding beyond just applications using the exchange module. This broadened participation boosted the auction's effectiveness and scalability. Injective is set to hit a major milestone this week, achieving the mark of 6,000,000 INJ burned, which is one of the highest total token burns in crypto history.

⛽️ Gas Compression

Gas optimization reduced transaction fees to approximately $0.0003, equating to an annual gas savings of over $239,000,000 for Injective users.

5⃣ INJ 3.0 Upgrades

The introduction of INJ 3.0 marked a significant advancement in the tokenomics of Injective, focusing on enhancing its deflationary properties and optimizing the economic structure.

🌻 Mint Module Parameter Adjustments

INJ 3.0 involved crucial changes to the mint module parameters to support a deflationary economic model.

The primary adjustments include:

👉Increased Supply Rate Change: The Supply Rate Change parameter was raised from 10% to 50%, accelerating the responsiveness of supply adjustments based on the bonded-stake ratio.

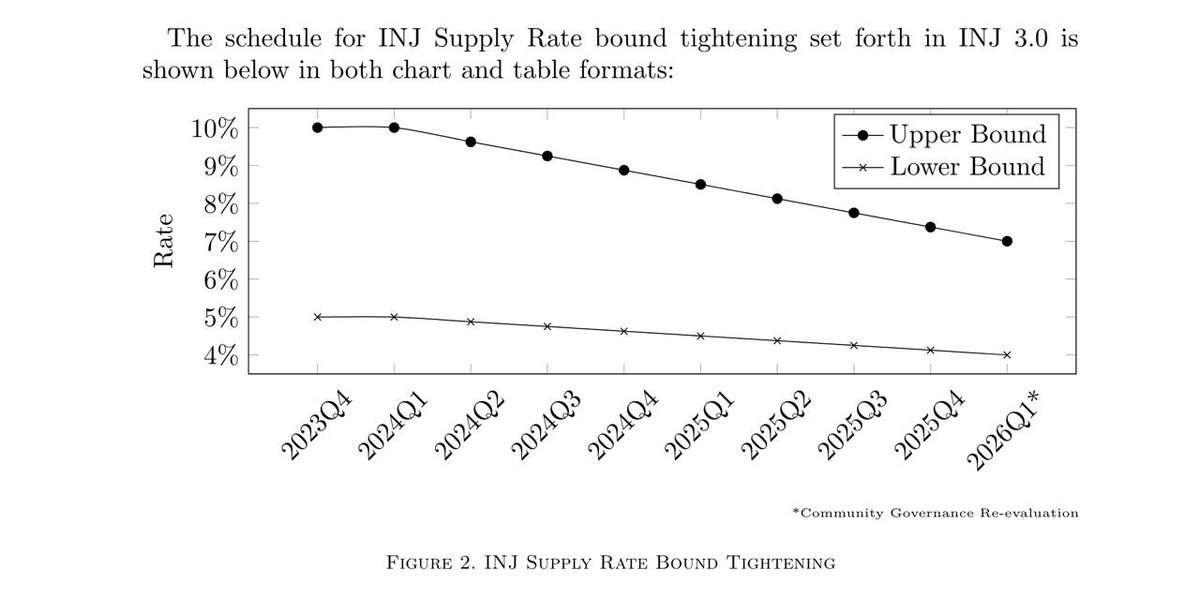

👉Scheduled Decreases in Supply: The upper and lower bounds of the Supply Rate decrease quarterly over the next two years. The lower bound will decrease by 25%, from 5% to 4%, and the upper bound will decrease by 30%, from 10% to 7%. This schedule aims to gradually reduce the overall supply rate, increasing INJ's rate of deflation by a factor of 400%.

⚡️Deflationary Effects

The INJ 3.0 upgrade significantly enhances the deflationary properties of the INJ token through the following mechanisms:

👉Reduced Minting: By tightening the supply rate bounds and increasing the rate of adjustment, the overall supply of newly minted INJ decreases, reducing inflationary pressure.

👉Increased Burn Auction Size: As the ecosystem grows, the size of each Burn Auction is set to increase. This means more INJ is burned regularly, continuously reducing the supply.

The dynamic interplay between the reduced minting and increased Burn Auction size creates a feedback loop that perpetuates deflationary acceleration. This mechanism allows for the total supply of INJ to decrease over time, promoting long-term stability and horizontal scalability within the Injective ecosystem.

☂️Conclusion

Injective’s innovative approach to tokenomics, characterized by dynamic supply control and strategic token burns, exemplifies a robust model for managing the economics of blockchain networks. The introduction of INJ 3.0 has significantly enhanced the deflationary properties of the INJ token, ensuring a controlled and continuously decreasing supply. This comprehensive system supports ecosystem growth and promotes active community engagement. By carefully balancing supply and demand, Injective maintains long-term stability and positions itself as a resilient and vital player in the blockchain industry. For a deeper understanding of INJ’s economic design and its impact on the Injective ecosystem, be sure to explore the full paper here:

9.59K

238

GamerHash AI

With $GHX on the rise, Decentralized AI and DePIN technology are the most potent narratives of the imminent future 🚀

At GamerHash AI we're fighting GPU scarcity on a global scale and delivering high quality utility in form of an entire AI tools powerhouse - entirely for free! 🌐

Check out the GamerHash AI App if you haven't already! 🤝

Our Crypto Talk

List of 75+ #altcoins with 10-100x Potential For This Bull Cycle! 🤯

➼ Layer 1 : $S, $INJ, $KAS, $SUI, $XEL, $KOIN, $SEI

➼ RWA : $ALGO, $PROPC, $PROPS, $CPOOL, $BKN, $RIO

➼ AI : $RENDER $QUBIC, $TAO, $OPM, $CGPT, $VRA

➼ GameFi : $NAKA, $GFAL, $GHX, $SAND, $CREO,

➼ De-PIN : $RENDER, $FLUX, $OCTA, $AKT, $NCDT

➼ AI Agents : $GOAT, $SPEC, $AIXBT, $PAAL

➼ Privacy : $ZANO, $ANYONE, $FIRO, $ROSE

..and many more!

Don't forget to save this narrative thread for future reference.

Explore several compelling narratives. 🧵 🔽

17.66K

68

TOP 7 ICO | Crypto News & Analytics

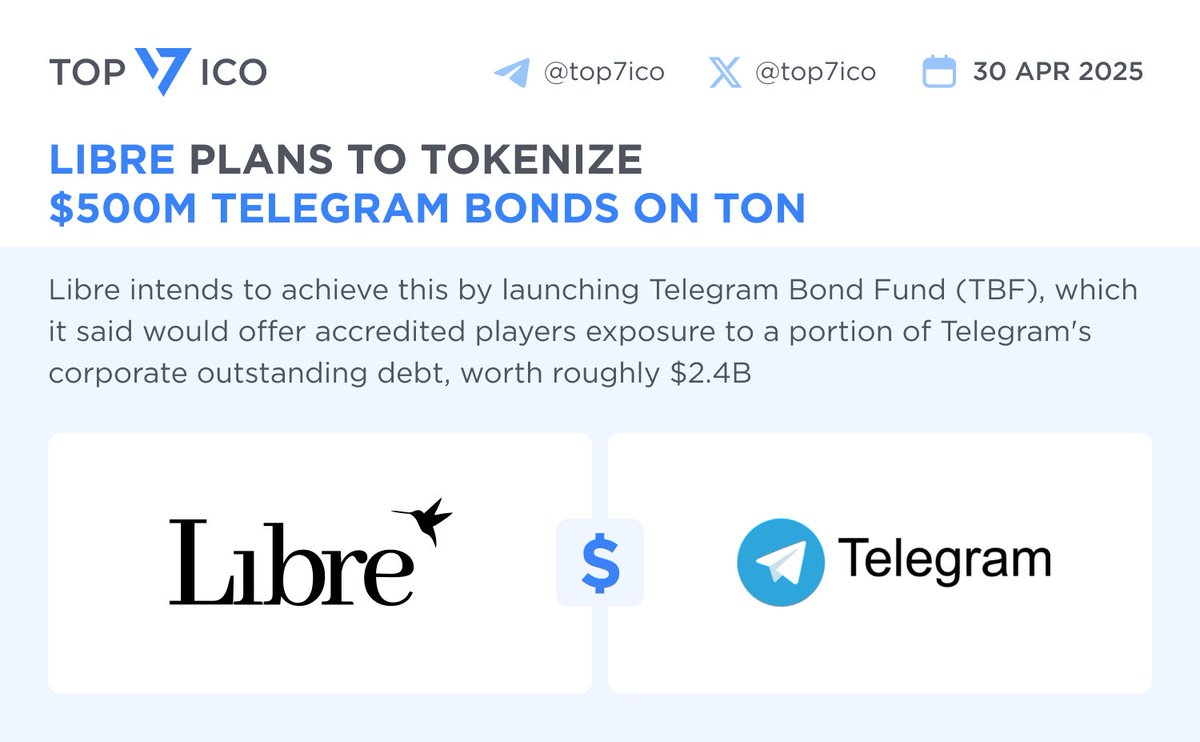

Libre plans to tokenize $500M Telegram bonds on @ton_blockchain

@librecap intends to achieve this by launching @telegram Bond Fund (TBF), which it said would offer accredited players exposure to a portion of Telegram's corporate outstanding debt, worth roughly $2.4B.

Libre has already tokenized real-world assets from top asset managers such as @BlackRock and operates on several networks, including @injective, @NEARProtocol, @solana, and @ethereum scaling solutions.

🔗

13.82K

7

Injective price performance in USD

The current price of Injective is $9.4720. Over the last 24 hours, Injective has decreased by -4.33%. It currently has a circulating supply of 97,727,220 INJ and a maximum supply of 100,000,000 INJ, giving it a fully diluted market cap of $928.41M. At present, the Injective coin holds the 53 position in market cap rankings. The Injective/USD price is updated in real-time.

Today

-$0.42900

-4.34%

7 days

-$0.01600

-0.17%

30 days

+$0.66200

+7.51%

3 months

-$10.4510

-52.46%

Popular Injective conversions

Last updated: 04/30/2025, 23:48

| 1 INJ to USD | $9.5000 |

| 1 INJ to PHP | ₱530.54 |

| 1 INJ to EUR | €8.3565 |

| 1 INJ to IDR | Rp 157,807.3 |

| 1 INJ to GBP | £7.1305 |

| 1 INJ to CAD | $13.1490 |

| 1 INJ to AED | AED 34.8931 |

| 1 INJ to VND | ₫247,074.1 |

About Injective (INJ)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Injective FAQ

How much is 1 Injective worth today?

Currently, one Injective is worth $9.4720. For answers and insight into Injective's price action, you're in the right place. Explore the latest Injective charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Injective, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Injective have been created as well.

Will the price of Injective go up today?

Check out our Injective price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials