FXS

Frax Share price

$3.7180

-$0.16200

(-4.18%)

Price change for the last 24 hours

How are you feeling about FXS today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Frax Share market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$336.79M

Circulating supply

90,657,196 FXS

90.94% of

99,681,496 FXS

Market cap ranking

103

Audits

Last audit: May 23, 2021

24h high

$4.0580

24h low

$3.6920

All-time high

$11.0000

-66.20% (-$7.2820)

Last updated: Jul 6, 2023

All-time low

$1.2460

+198.39% (+$2.4720)

Last updated: Mar 11, 2025

Frax Share Feed

The following content is sourced from .

Phan Đạt

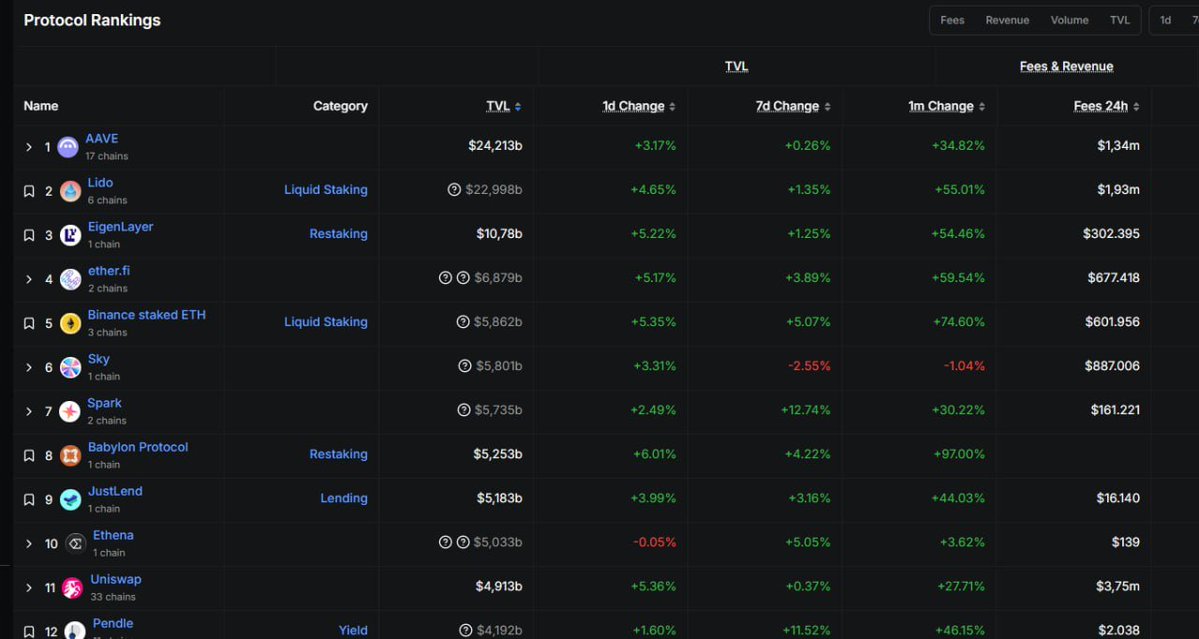

The TVL of $AAVE has grown significantly; could DeFi Summer be making a comeback?

The total value locked (TVL) of $AAVE has surpassed $LIDO, increasing by 50% from the year's low of $20 billion to an all-time high on May 12th with $40 billion, solidifying its position as the leading lending protocol on Ethereum and the second-largest decentralized application by TVL.

This recovery marks a strong confidence in Ethereum's DeFi ecosystem, which had seen a decline in activity earlier this year. At the time of writing, $AAVE is generating over $1 million in daily transaction fees, indicating active protocol usage far beyond passive capital deposits.

$AAVE is proving its superiority in both product and token price trajectory despite Ethereum's sluggishness and the "aggressiveness" of the Solana ecosystem.

Currently, $AAVE is fluctuating at a price of $260, driving the growth of a series of other DeFi protocols.

If DeFi Summer truly happens, these are the DeFi projects everyone should watch:

$COW (CoW Protocol): A DeFi protocol focused on optimizing transactions through the "Coincidence of Wants" mechanism, reducing gas costs and avoiding front-running. It provides a decentralized exchange solution with a smooth user experience, integrated with DEX platforms.

$ENA (Ethena): A project developing the decentralized stablecoin USDe, backed by Ethereum staking assets and using a delta-neutral strategy to maintain stable prices. Ethena aims to provide a high-yield, low-risk decentralized financial solution.

$FXS (Frax Share): The governance token of the Frax Protocol, a hybrid stablecoin system (partially collateralized) with FRAX as the main stablecoin. FXS is used for voting, staking, and profit sharing, supporting FRAX price stability through an algorithmic mechanism.

$PENDLE: A DeFi protocol that allows for the tokenization and trading of future yield. Pendle separates yield from staking assets or liquidity provision, creating a market for buying, selling, or hedging yield.

#DeFi

Show original

27K

8

TechFlow

By Alex Liu, Foresight News

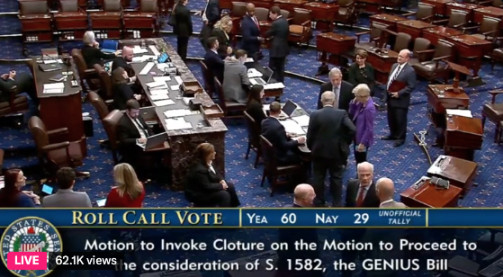

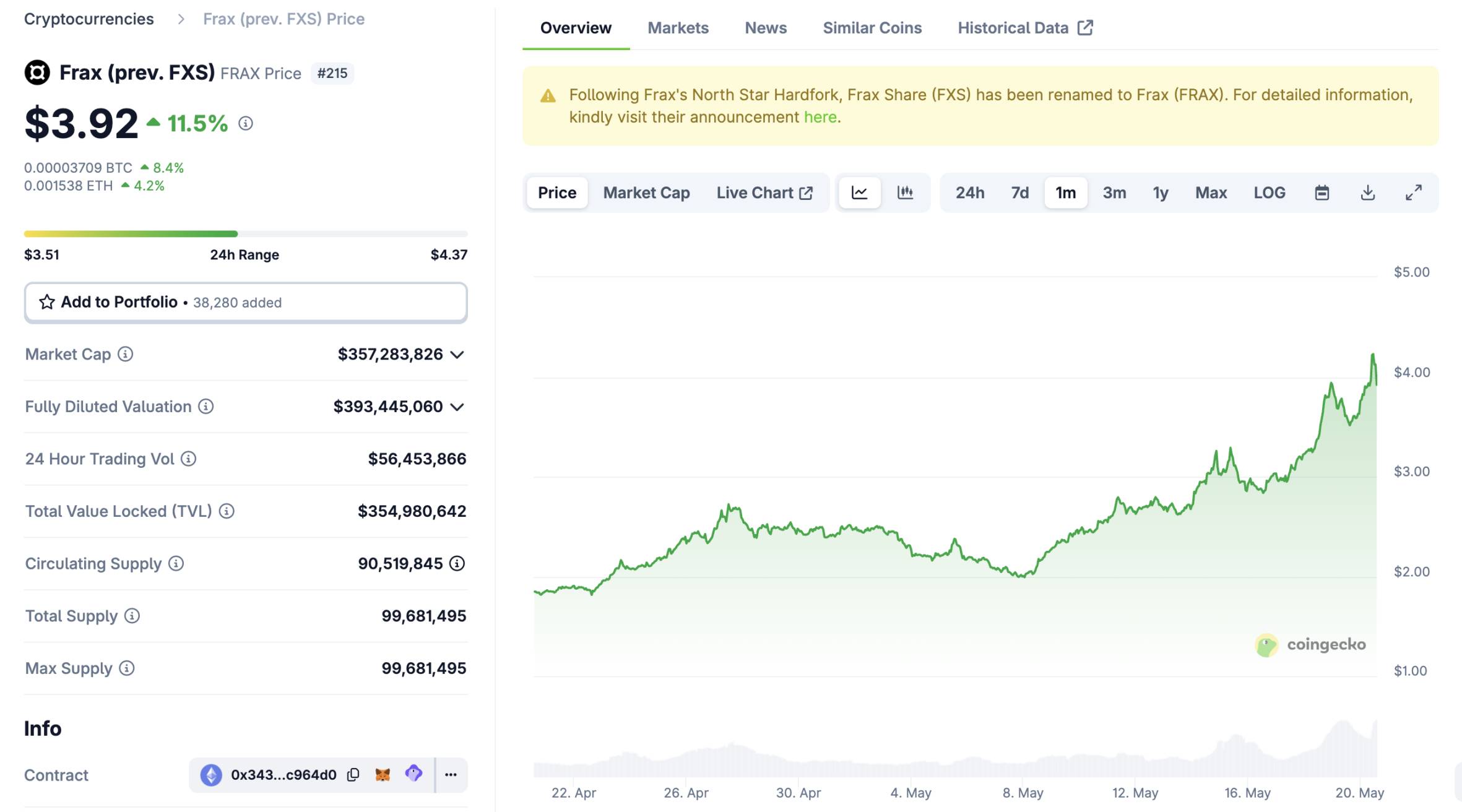

The Stablecoin Act vs. FXS

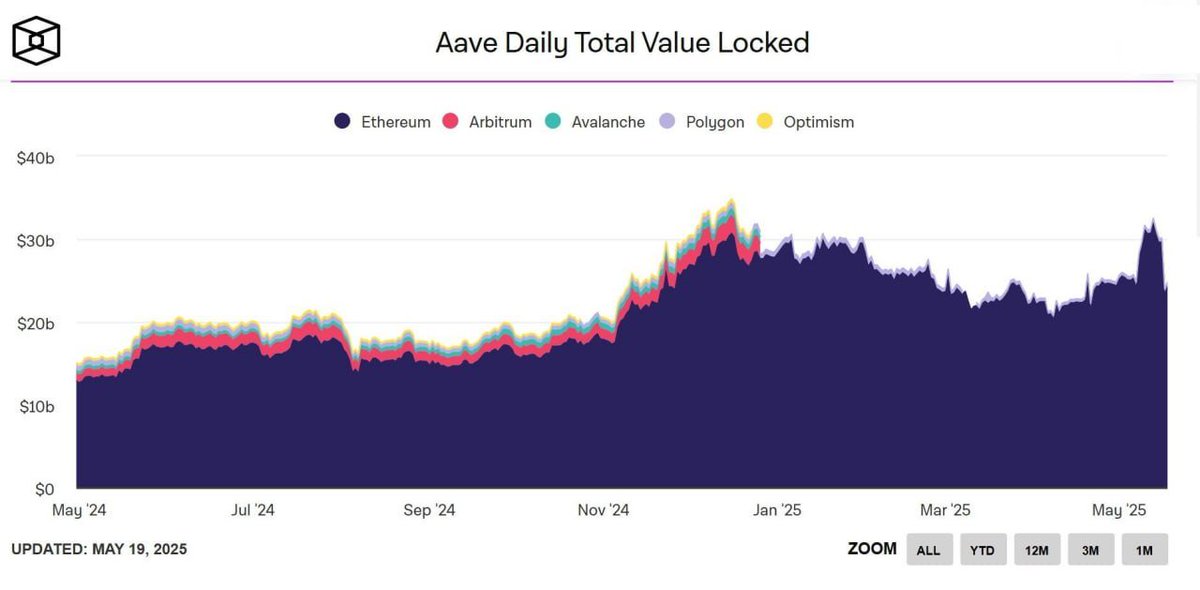

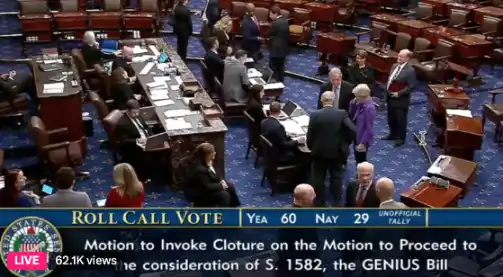

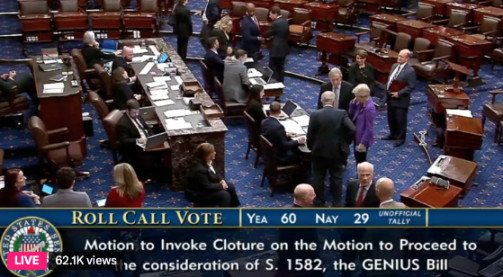

On May 20, the GENIUS Act, a legislative bill for stablecoins in the United States, was voted in the Senate, and there are still two major steps before the House of Representatives vote and the president's signature. Markets previously believed that a vote in the Senate was the biggest obstacle to the bill's passage, and barring any surprises, it would only be a matter of time before the bill was fully passed.

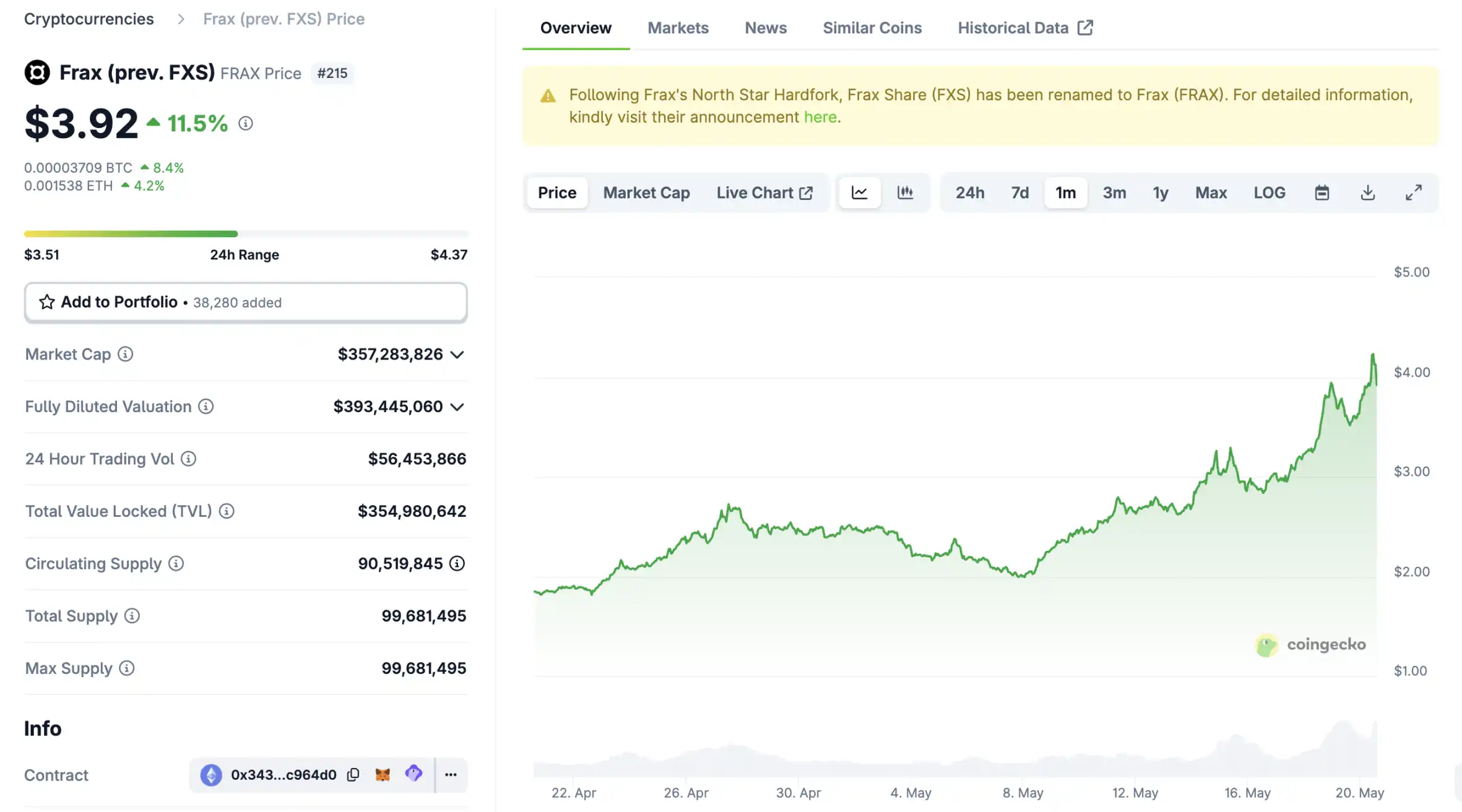

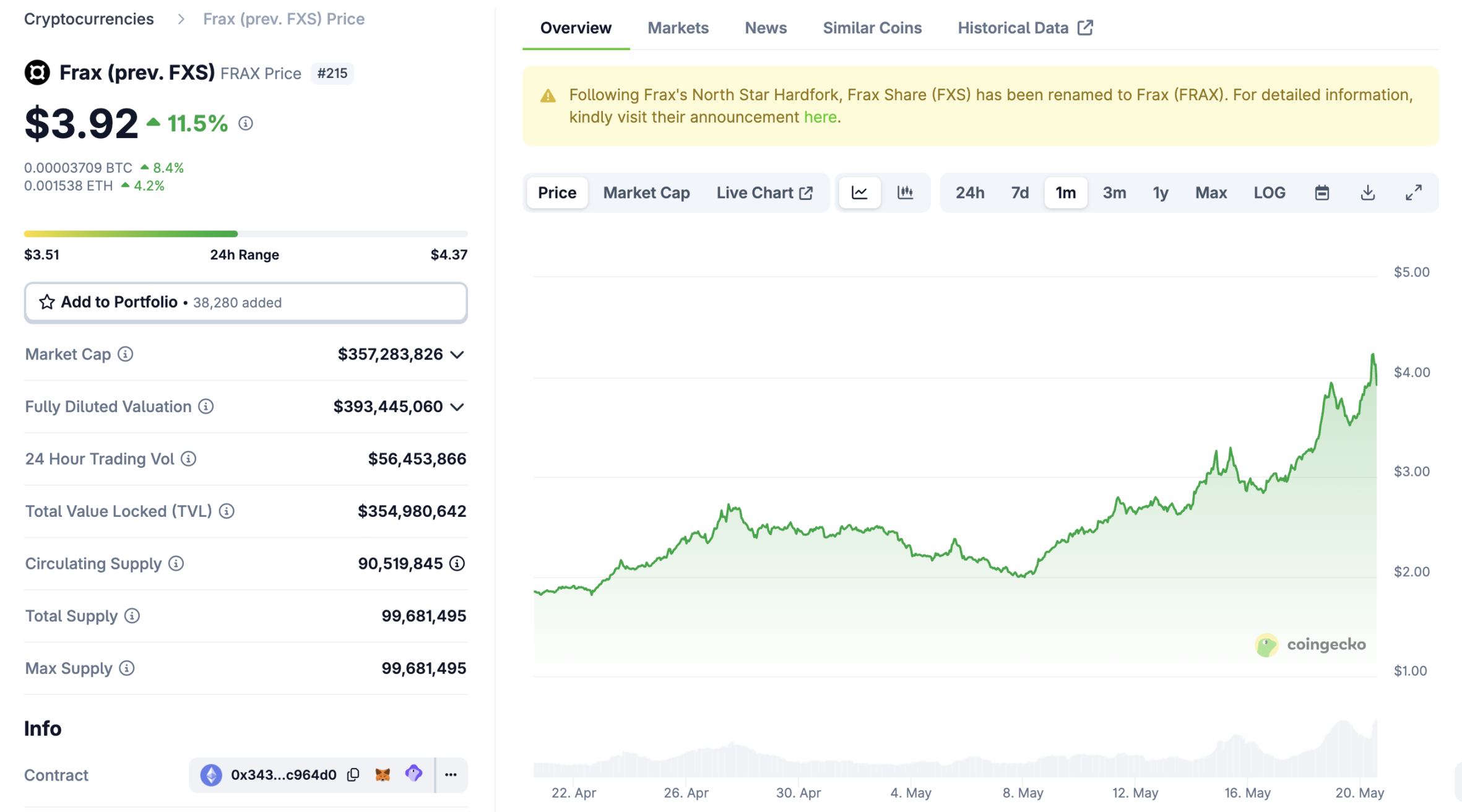

Which crypto project is the biggest winner of this legislative victory? In terms of token price performance, it could be Frax Finance.

With the passage of the bill in the Senate, the Frax Finance token FXS (now renamed FRAX, which has not yet been updated on centralized exchanges) briefly rose above 4.4 USDT, ranking first among mainstream exchanges. Even with a slight correction in the price at the moment, FXS is still up more than 100% in the month.

Why is the bill good for Frax Finance, and why is Frax seen by some as the biggest winner of the GENIUS Act?

Frax Finance

Frax Finance's products are not just stablecoins, but also liquid staking, lending, L2, and more. But they have deep roots in stablecoins. Frax used to be the issuer of the hybrid algorithmic stablecoin FRAX, but it abandoned the "computational" track after the Luna UST crash and transformed into a fully collateralized stablecoin.

Since then, FRAX has been further updated to frxUSD, secured by fiat currency, "with the entire roadmap to become the first licensed fiat currency stablecoin".

Frax founder Sam hinted that Frax benefited the most from the bill

But why did frxUSD become the "first" licensed fiat currency stablecoin before USDC, USDY and other products? At the regulatory level, it really has the possibility of "being close to the water, first getting the first month".

Sam Kazemian, the founder of Frax Finance, has frequently posted photos of himself with crypto legislators in Washington, D.C., since the beginning of the year. He is rumored to have been deeply involved in the discussion and drafting of the GENIUS Act as an industry insider. The market seems to be pricing in the regulatory advantage that Frax Finance will have accordingly.

Sam poses with crypto-friendly Senator Lummis

If the speculation is true, Sam, as a drafter and participant in the bill, naturally has a deeper understanding of the GENIUS Act, and it is easier for his project to meet the requirements. In addition, it remains to be seen whether friendly relations with legislators will give the regulatory green light for the future of FRAX.

The future route of FRAX

In addition to potential regulatory opportunities, FRAX is building a vertically integrated stablecoin ecosystem, including frxUSD (stablecoin), FraxNet (bank interface), and Fraxtal (L2 execution layer), to accommodate the needs of the future regulatory environment:

frxUSD: As a stablecoin for FRAX, pegged 1:1 to the U.S. dollar.

FraxNet: A banking interface designed to connect the traditional financial system with DeFi.

Fraxtal: An L2 execution layer (or a gradual shift to L1) that provides efficient trading and scalability.

The token restructuring is also part of FRAX's future plans. FXS has rebranded to FRAX and given it features such as Gas, Governance, Burning, and Staking. This change is designed to enhance FRAX's functionality and market competitiveness, allowing it to operate more flexibly in a compliant environment.

Staking FRAX as veFRAX can get potential rewards such as FXTL (Frax's own points), Karak, Ethena, and Symbiotic points.

The founders actively operate and participate in stablecoin-related legislation, and their own product roadmap is actively adjusted to narrative services. With the further implementation of the GENIUS Act, the performance of FXS (FRAX) is worth looking forward to.

Show original

7.76K

0

比特币橙子Trader

Orange Evening Analysis 5.20

GENIUS Stablecoin Act advances further in the Senate! Crypto market is boiling, #RWA #Stablecoin sectors are taking off, with a potential capital exposure of up to $2 trillion. Dollar hegemony + new play for U.S. Treasury bonds—could this signal an altcoin bull run?

The biggest news last night was that the GENIUS Stablecoin Act passed the Senate's second procedural motion vote. While this doesn’t mean the bill is passed, it’s a significant step forward compared to the bearish news on May 8, when the procedural vote failed due to the Democratic Party withdrawing support (concerns over anti-money laundering and Trump-related conflicts of interest). Essentially, this marks a restart for the bill. The next steps include Senate debates and amendments, a final Senate vote, House review, bicameral coordination, and presidential signing. Although the road to final legislation is still long—earliest completion expected by August—the impact of this stablecoin bill on crypto is immense. Even crypto czar David Sacks tweeted that this procedural approval is a major victory for the cryptocurrency sector. Coinbase CEO also stated that if the bill passes, it would be a huge win for on-chain innovation. White House digital asset advisor Bo Hines believes the GENIUS Act will solidify the dollar’s dominance and position U.S. asset innovation as a global leader.

Many people might still be unclear about the specific benefits this bill brings to crypto. Firstly, it opens up massive capital exposure. The stablecoins we currently use, like USDC and USDT, are still considered niche assets by Wall Street, with compliance and regulation being the main barriers to large-scale institutional entry. If the stablecoin bill passes, institutions will have no more concerns. Elizabeth Warren even estimated that this bill could expand the stablecoin market size from $200 billion to $2 trillion, which is close to Canada’s GDP. Imagine this scale of capital entering the crypto market—wouldn’t everything skyrocket? Altcoin bull runs wouldn’t be a concern anymore.

Secondly, the global status of the dollar would be safeguarded. On-chain stablecoins and investments would become new reservoirs for U.S. Treasury bonds. Whether the new stablecoin is USD1 or USD2, the underlying asset will ultimately be U.S. Treasury bonds. Trump’s push for this stablecoin bill, even personally promoting it, is essentially aimed at weakening the dollar while ensuring its global influence. This requires enhancing the utility of U.S. Treasury bonds. Currently, Tether’s holdings of U.S. Treasury bonds are already among the top globally, surpassing Germany’s reserves as of last night’s news. If dozens or hundreds more Tethers are created in the future, U.S. Treasury bonds might not even be sufficient. This way, the U.S. debt crisis could be controlled. Trump’s earlier statement about relying on crypto to solve the U.S. debt problem might ultimately hinge on the stablecoin plan. With the current $37 trillion U.S. Treasury bond market, the capital influx into on-chain and crypto markets would be even larger. Therefore, if this bill passes, it would undoubtedly be a super bullish event, surpassing Bitcoin spot ETFs or even national strategic reserve-level benefits.

Because of this bill, today’s #RWA #Stablecoin sectors have surged. Let’s start with RWA. Since stablecoins are pegged to U.S. Treasury bonds or dollar-equivalent assets, they essentially qualify as real-world assets (RWA). Moreover, if the dollar can go on-chain, other physical and financial assets can also go on-chain. The method for on-chain integration would likely rely on existing infrastructure. Thus, #RWA is bound to be a super sector for a long time. Today, almost all RWA-related projects have surged, especially the new RWA stars on-chain like $collat, $kta, $token, $mpl, etc., with gains exceeding 30%. Leading projects like $ondo, $link, $mkr, $syrup, $om also showed strong performance, with single-day gains exceeding 5%.

Next is stablecoin protocols. Although there’s been much discussion today suggesting that the stablecoin bill is actually bearish for existing decentralized stablecoin protocols—since the future market will likely only recognize stablecoins collateralized by the dollar—the current stablecoin protocols were designed to counter centralized fiat currencies. They’ve implemented various mechanisms to optimize fiat currencies. However, Luna’s collapse has shown the limitations of pure algorithmic stablecoins. Over-collateralized or semi-algorithmic models either suffer from low capital efficiency or are prone to de-pegging, making it difficult to sustain large-scale operations. Theoretically, if hundreds more USDTs are created, decentralized stablecoins might struggle to find a foothold. Nonetheless, there’s still short-term speculative potential. Last night, $aave, $fxs, $ena, $pendle, $crv all saw gains of 10-20%, indicating that centralized exchanges (CEXs) currently have no other options but to play this concept.

As for on-chain meme coins, there wasn’t much action last night. I mentioned in a previous article that the “believe” strategy has diverted too much in-market capital to traditional Web2, causing a drop in retail investor confidence and sentiment. This marks a short-term peak. The next trend might return to mainstream narratives like RWA, AI, DeFi, PayFi, and L1. However, a true altcoin bull run will only happen after Bitcoin officially reaches ATH. This round of altcoin bull runs might occur after Bitcoin hits $120k, so everyone should patiently wait.

Show original

68.29K

11

Blockbeats

Original title: "Why did FRAX become the biggest winner after the stablecoin bill passed?" 》

Original article by Alex Liu, Foresight News

The Stablecoin Act vs. FXS

On May 20, the GENIUS Act, a legislative bill for stablecoins in the United States, was voted in the Senate, and there are still two major steps before the House of Representatives vote and the president's signature. Markets previously believed that a vote in the Senate was the biggest obstacle to the bill's passage, and barring any surprises, it would only be a matter of time before the bill was fully passed.

Which crypto project is the biggest winner of this legislative victory? In terms of token price performance, it could be Frax Finance.

With the passage of the bill in the Senate, the Frax Finance token FXS (now renamed FRAX, which has not yet been updated on centralized exchanges) briefly rose above 4.4 USDT, ranking first among mainstream exchanges. Even with a slight correction in the price at the moment, FXS is still up more than 100% in the month.

Why is the bill good for Frax Finance, and why is Frax seen by some as the biggest winner of the GENIUS Act?

Frax Finance

Frax Finance's products are not just stablecoins, but also liquid staking, lending, L2, and more. But they have deep roots in stablecoins. Frax used to be the issuer of the hybrid algorithmic stablecoin FRAX, but it abandoned the "computational" track after the Luna UST crash and transformed into a fully collateralized stablecoin.

Since then, FRAX has been further updated to frxUSD, secured by fiat currency, "with the entire roadmap to become the first licensed fiat currency stablecoin".

Frax founder Sam hinted that Frax benefited the most from the bill

But why did frxUSD become the "first" licensed fiat currency stablecoin before USDC, USDY and other products? At the regulatory level, it really has the possibility of "being close to the water, first getting the first month".

Sam Kazemian, the founder of Frax Finance, has frequently posted photos of himself with crypto legislators in Washington, D.C., since the beginning of the year. He is rumored to have been deeply involved in the discussion and drafting of the GENIUS Act as an industry insider. The market seems to be pricing in the regulatory advantage that Frax Finance will have accordingly.

Sam poses with crypto-friendly Senator Lummis

If the speculation is true, Sam, as the drafter and participant of the bill, naturally has a deeper understanding of the GENIUS Act, and it is easier for his project to meet the requirements. In addition, it remains to be seen whether friendly relations with legislators will give the regulatory green light for the future of FRAX.

The future route of FRAX

In addition to potential regulatory opportunities, FRAX is building a vertically integrated stablecoin ecosystem, including frxUSD (stablecoin), FraxNet (bank interface), and Fraxtal (L2 execution layer), to accommodate the needs of the future regulatory environment:

· frxUSD: As a stablecoin for FRAX, pegged 1:1 to the U.S. dollar

· FraxNet: A banking interface designed to connect the traditional financial system with DeFi

· Fraxtal: An L2 execution layer (or a gradual shift to L1) that provides efficient trading and scalability

The token restructuring is also part of FRAX's future plans. FXS has rebranded to FRAX and given it features such as Gas, Governance, Burning, and Staking. This change is designed to enhance FRAX's functionality and market competitiveness, allowing it to operate more flexibly in a compliant environment.

Staking FRAX as veFRAX can get potential rewards such as FXTL (Frax's own points), Karak, Ethena, and Symbiotic points.

The founders actively operate and participate in stablecoin-related legislation, and their own product roadmap is actively adjusted to narrative services. With the further implementation of the GENIUS Act, the performance of FXS (FRAX) is worth looking forward to.

Link to original article

Show original

6.57K

0

Odaily

Original article by Alex Liu, Foresight News

The Stablecoin Act vs. FXS

On May 20, the GENIUS Act, a legislative bill for stablecoins in the United States, was voted in the Senate, and there are still two major steps before the House of Representatives vote and the president's signature. Markets previously believed that a vote in the Senate was the biggest obstacle to the bill's passage, and barring any surprises, it would only be a matter of time before the bill was fully passed.

Which crypto project is the biggest winner of this legislative victory? In terms of token price performance, it could be Frax Finance.

With the passage of the bill in the Senate, the Frax Finance token FXS (now renamed FRAX, which has not yet been updated on centralized exchanges) briefly rose above 4.4 USDT, ranking first among mainstream exchanges. Even with a slight correction in the price at the moment, FXS is still up more than 100% in the month.

Why is the bill good for Frax Finance, and why is Frax seen by some as the biggest winner of the GENIUS Act?

Frax Finance

Frax Finance's products are not just stablecoins, but also liquid staking, lending, L2, and more. But they have deep roots in stablecoins. Frax used to be the issuer of the hybrid algorithmic stablecoin FRAX, but it abandoned the "computational" track after the Luna UST crash and transformed into a fully collateralized stablecoin.

Since then, FRAX has been further updated to frxUSD, secured by fiat currency, "with the entire roadmap to become the first licensed fiat currency stablecoin".

Frax founder Sam hinted that Frax benefited the most from the bill

But why did frxUSD become the "first" licensed fiat currency stablecoin before USDC, USDY and other products? At the regulatory level, it really has the possibility of "being close to the water, first getting the first month".

Sam Kazemian, the founder of Frax Finance, has frequently posted photos of himself with crypto legislators in Washington, D.C., since the beginning of the year. He is rumored to have been deeply involved in the discussion and drafting of the GENIUS Act as an industry insider. The market seems to be pricing in the regulatory advantage that Frax Finance will have accordingly.

Sam poses with crypto-friendly Senator Lummis

If the speculation is true, Sam, as a drafter and participant in the bill, naturally has a deeper understanding of the GENIUS Act, and it is easier for his project to meet the requirements. In addition, it remains to be seen whether friendly relations with legislators will give the regulatory green light for the future of FRAX.

The future route of FRAX

In addition to potential regulatory opportunities, FRAX is building a vertically integrated stablecoin ecosystem, including frxUSD (stablecoin), FraxNet (bank interface), and Fraxtal (L2 execution layer), to accommodate the needs of the future regulatory environment:

frxUSD: As a stablecoin for FRAX, pegged 1:1 to the US dollar.

FraxNet: A banking interface designed to connect the traditional financial system with DeFi.

Fraxtal: An L2 execution layer (or a gradual shift to L1) that provides efficient trading and scalability.

The token restructuring is also part of FRAX's future plans. FXS has rebranded to FRAX and given it features such as Gas, Governance, Burning, and Staking. This change is designed to enhance FRAX's functionality and market competitiveness, allowing it to operate more flexibly in a compliant environment.

Staking FRAX as veFRAX can get potential rewards such as FXTL (Frax's own points), Karak, Ethena, and Symbiotic points.

The founders actively operate and participate in stablecoin-related legislation, and their own product roadmap is actively adjusted to narrative services. With the further implementation of the GENIUS Act, the performance of FXS (FRAX) is worth looking forward to.

Link to original article

Show original

6.47K

0

FXS calculator

Frax Share price performance in USD

The current price of Frax Share is $3.7180. Over the last 24 hours, Frax Share has decreased by -4.18%. It currently has a circulating supply of 90,657,196 FXS and a maximum supply of 99,681,496 FXS, giving it a fully diluted market cap of $336.79M. At present, the Frax Share coin holds the 103 position in market cap rankings. The Frax Share/USD price is updated in real-time.

Today

-$0.16200

-4.18%

7 days

+$0.65600

+21.42%

30 days

+$1.8160

+95.47%

3 months

+$1.8120

+95.06%

Popular Frax Share conversions

Last updated: 05/21/2025, 17:05

| 1 FXS to USD | $3.7150 |

| 1 FXS to PHP | ₱206.96 |

| 1 FXS to EUR | €3.2952 |

| 1 FXS to IDR | Rp 61,001.64 |

| 1 FXS to GBP | £2.7751 |

| 1 FXS to CAD | $5.1639 |

| 1 FXS to AED | AED 13.6341 |

| 1 FXS to VND | ₫96,418.38 |

About Frax Share (FXS)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Frax Share FAQ

How much is 1 Frax Share worth today?

Currently, one Frax Share is worth $3.7180. For answers and insight into Frax Share's price action, you're in the right place. Explore the latest Frax Share charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Frax Share, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Frax Share have been created as well.

Will the price of Frax Share go up today?

Check out our Frax Share price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

FXS calculator