数字货币交易,我们是专业的

最低的手续费,最快捷的交易,强劲的 API 以及更多最低的手续费,世界一流的撮合引擎,强劲的 API 以及更多

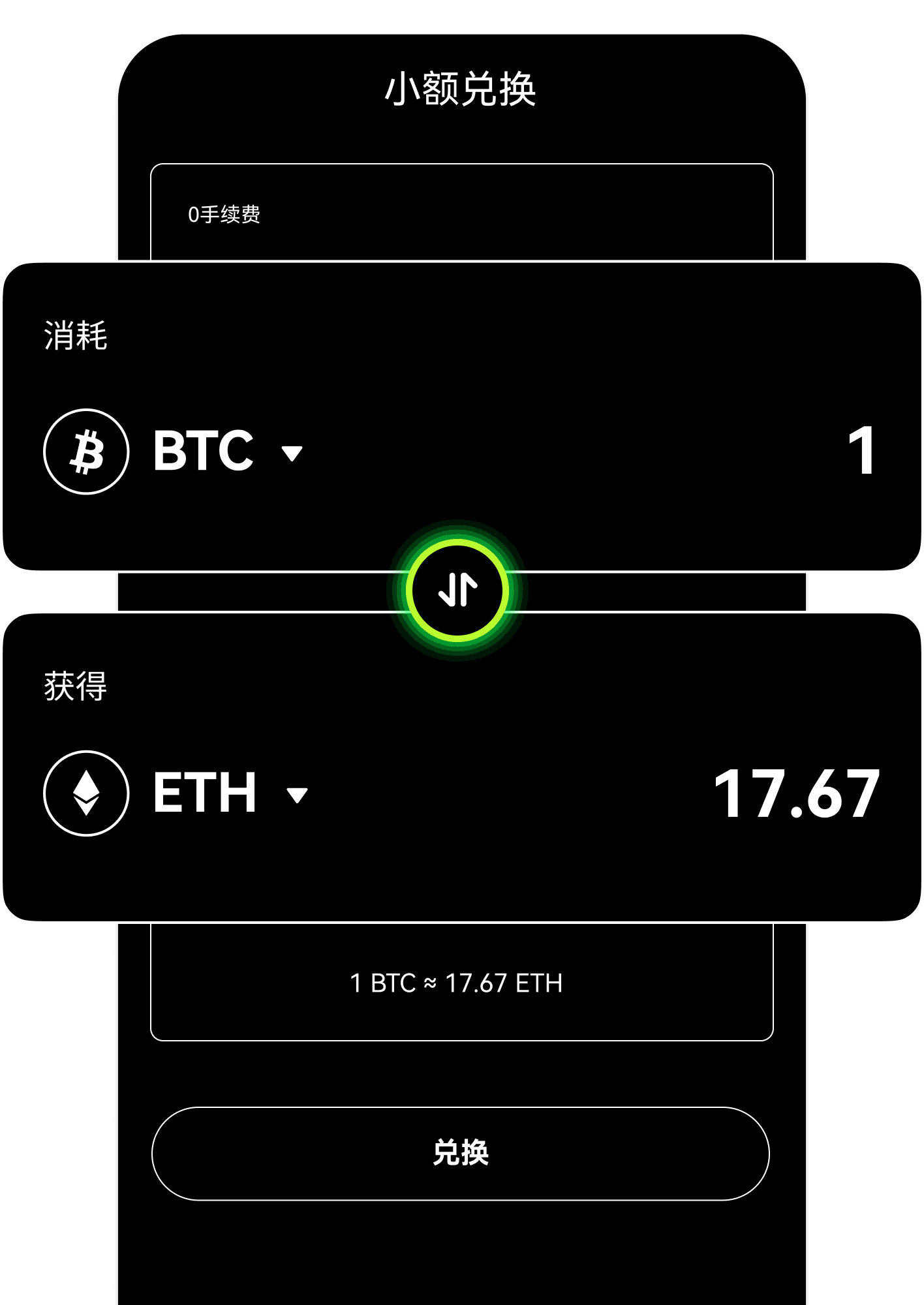

欧易 App,创造无限可能

初次交易?$5 即可小试牛刀,欧易和您一起步步登高

您数字货币之旅的得力助手

从数字货币交易初体验到第一次购买 NFT,欧易将助您轻松赚币

何塞普·瓜迪奥拉教练

讲解“疯狂足球战术”

重塑系统

欢迎来到 Web3

单板滑雪运动员斯科特·詹姆斯

带领全家欢聚

常见问题

欧易都提供哪些产品?

如何通过欧易平台购买比特币和其他货币?

什么是数字货币?