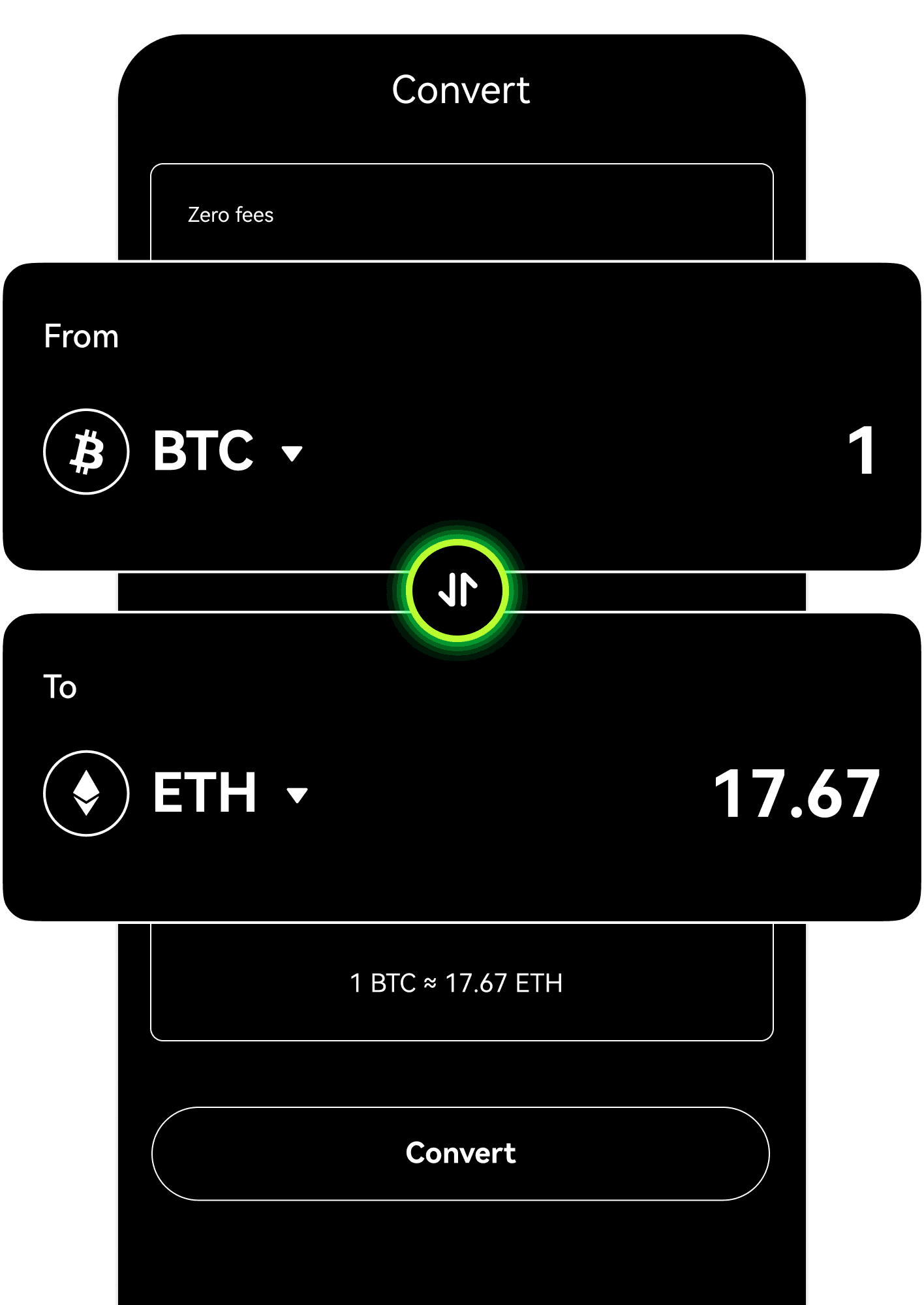

- Comprar/Vender

- Descobrir

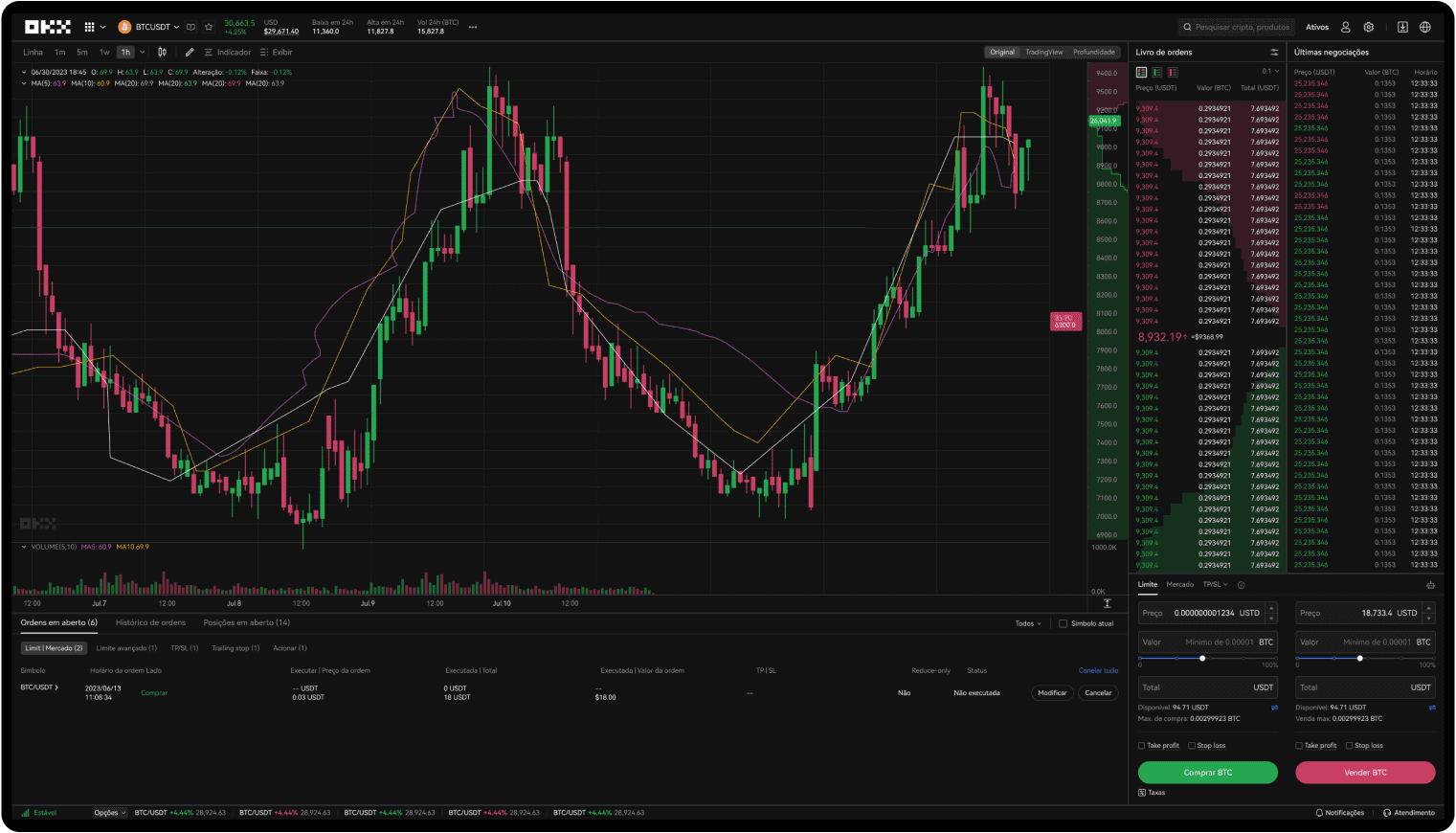

- Negociar

- Aumentar

- Criar

Rede da camada X

ExplorarEntre no mundo da Web3Camada XDesperte a sua criatividadeExplorador de mainnetExplorar dados on-chain da mainnetExplorador de testnetExplorar dados on-chain da testnetEcossistema da camada XExplorar DApps na camada XDesenvolvedoresExpandir sem limitesDocumentação para desenvolvedoresExplore os documentos do nosso protocoloFaucet da TestnetObter OKB na testnetPonte da testnetPonte da testnet da X LayerOracleObter dados de preçoGitHubExplorar repositórios da camada XDApps oficiaisProdutos de infraestrutura - InstitucionalPágina inicial institucionalO conjunto das soluções de trading de cripto mais eficientes do mundoMercado com liquidezRede de liquidez OTC para traders profissionais e institucionaisAPIsConectividade de API de latência ultrabaixa e contínuaEmpréstimo VIPAumentar a eficiência de capitalPrograma BrokerTenha acesso a uma profundidade de mercado de alto nível com comissões elevadasSubcontas gerenciadas de tradingGerencie subcontas, negocie com facilidade e segurança e com mais lucroDados históricos do mercadoGráficos de velas, trades agregados, dados de listas de ordens e muito maisInsights institucionaisNossas últimas pesquisas sobre negociação institucional, notícias e muito mais

- Tutoriais

- Mais

- EntrarCadastrar

- Atendimento