BTC

Bitcoin price

$105,775.8

+$2,147.90

(+2.07%)

Price change for the last 24 hours

How are you feeling about BTC today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Bitcoin market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$2,099.56B

Circulating supply

19,867,118 BTC

94.60% of

21,000,000 BTC

Market cap ranking

1

Audits

Last audit: --

24h high

$106,843.3

24h low

$102,108.3

All-time high

$109,800.0

-3.67% (-$4,024.20)

Last updated: 20 Jan 2025

All-time low

$67.8100

+155,888.49% (+$105,708.0)

Last updated: 6 Jul 2013

Bitcoin Feed

The following content is sourced from .

Odaily

Original | Odaily Daily (@OdailyChina)

Author|Azuma(@azuma_eth)

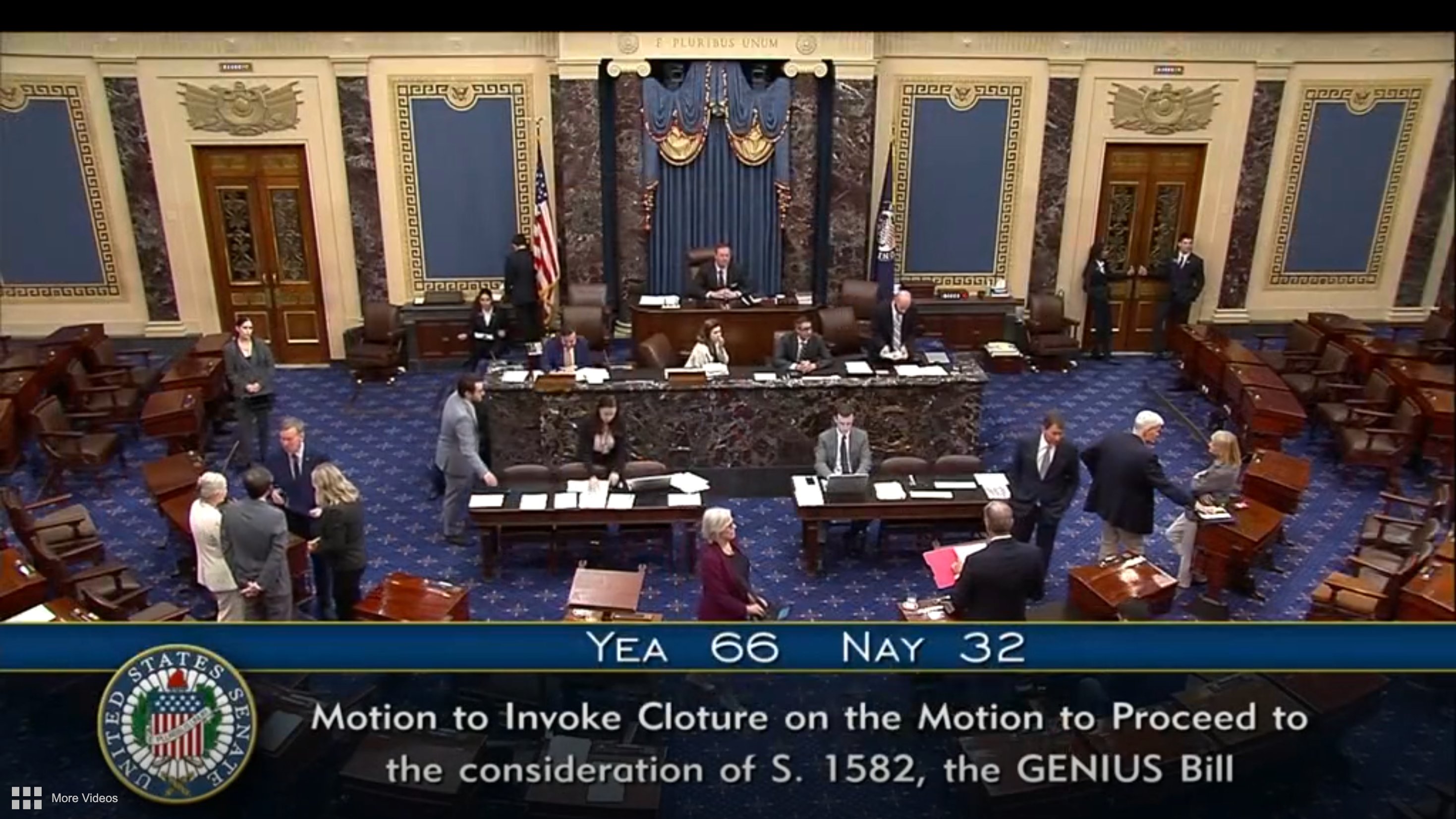

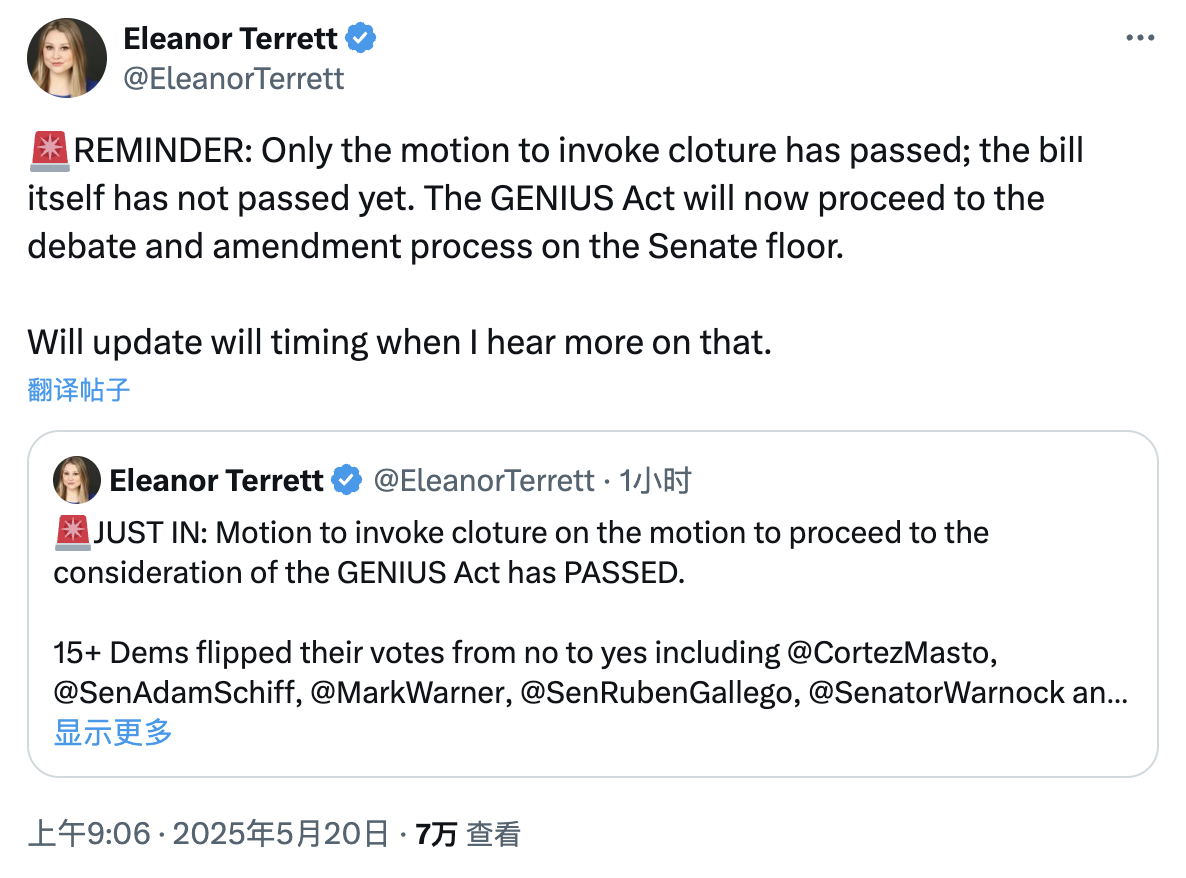

In the early morning of May 20, Beijing time, the much-watched stablecoin regulation bill (GENIUS Act) ushered in a key breakthrough in a vote in the U.S. Senate - the Senate voted 66 in favor and 32 against to pass the closing debate vote of the GENIUS Act. This means that the Senate has agreed to halt the debate on the bill, with a final vote coming in 30 hours at the latest.

Is the final vote complete?

It should be clearly emphasized that many media outlets and KOLs this morning have misreported the latest progress of the GENIUS Act, and in fact, the Senate voted to end the debate, and the bill itself has not yet passed the final vote.

However, this can still be seen as a key breakthrough for the GENIUS Act in getting through Congress, as the end of debate voting is a key mechanism in the U.S. Congressional legislative process, specifically designed to break the impasse in which the dissenting minority wants to block the bill's vote through "endless debate."

In the GENIUS Act case, Democratic senators, represented by Elizabeth Warren, have been the main force hindering the GENIUS Act process, and it was because of the collective opposition of Democratic senators that the GENIUS Act failed to advance further in the Senate vote on May 8 because it received only 49 votes (which did not meet the minimum requirement of 60 votes). However, in this morning's end-of-debate vote, 15 Democratic senators, including Adam Schiff, Mark Warner, and others, changed their vote from no to yes — meaning that in the upcoming final vote, this group of Democratic senators is likely to be a key force in the GENIUS Act running through the Senate.

Odaily Note: NBC reported that the reason for the multiple Democratic Senate vote changes was that bipartisan representatives negotiated an agreement last week, and in exchange, the bill added some amendments, including changes to consumer protections and restrictions on the issuance of stablecoins by tech companies, and expanded ethical standards to special government employees — which will apply to Musk and David Sacks for the time being.

GENIUS Act Content

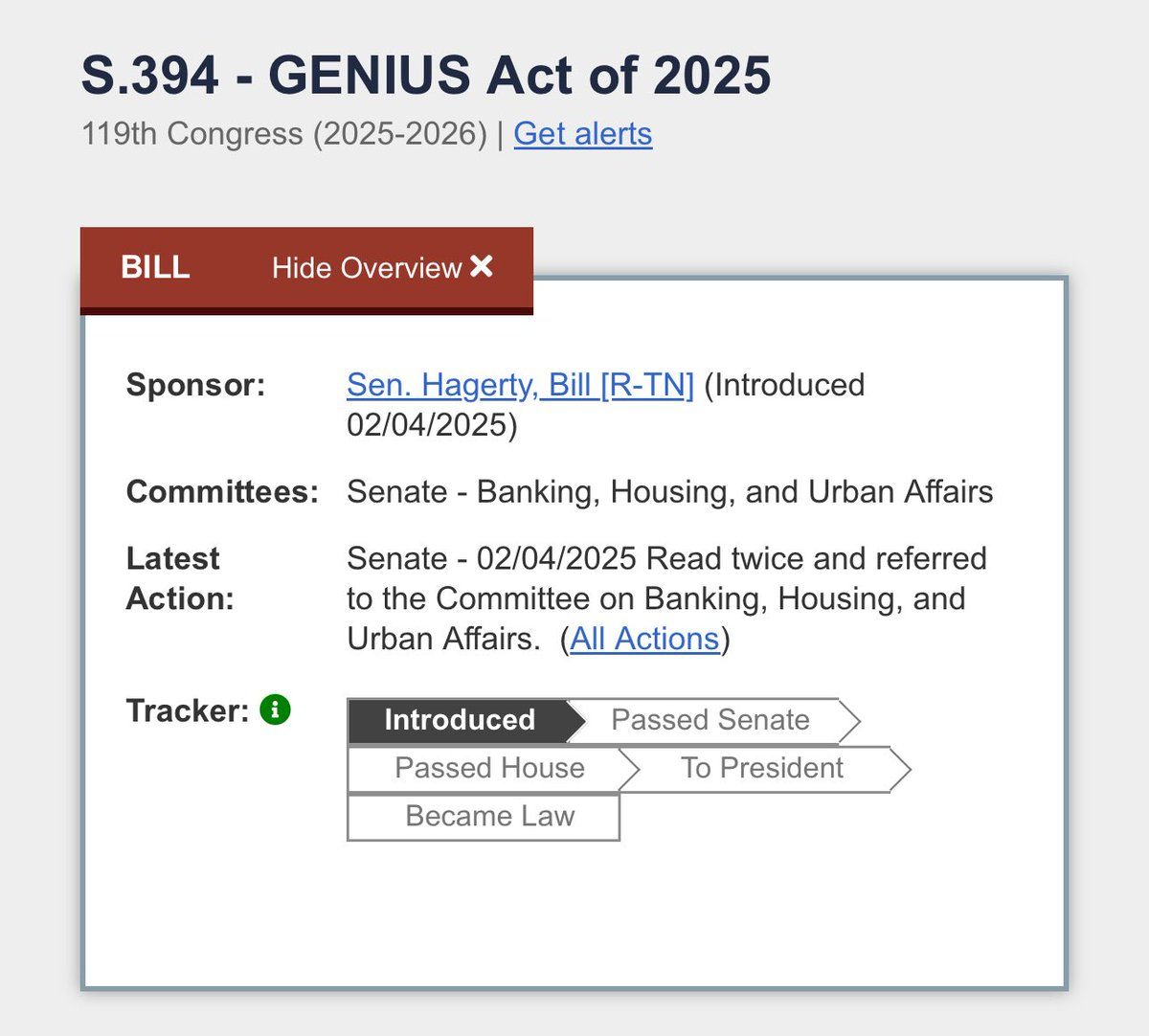

On February 4, 2025, U.S. Senators Bill Hagerty, Tim Scott, Kirsten Gillibrand, and Cynthia Lummis jointly proposed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS Act). It aims to establish a legal framework for the legal use of stablecoin payments in the United States.

The core provisions of the Act are as follows:

Payment Stablecoin Definition: A digital asset pegged to a fixed monetary value, fully backed by U.S. dollars or other highly liquid assets at a 1:1 ratio, dedicated to payment and settlement scenarios.

Dual-licensing regulation: Federally regulated, with issuers with a market capitalization of more than $10 billion subject to federal regulation; State-level regulation, with the option of state-level registration for small publishers (subject to federal equivalence).

100% Reserve Requirement: Reserve assets are limited to cash, short-term U.S. Treasury bonds, or central bank deposits, and must be segregated from working capital. A certificate of sufficiency of reserves is required to be submitted every month to ensure that users can redeem at face value.

Mandatory Disclosure of Transparency: Regular disclosure of reserve composition and redemption policies, compliance audits conducted by a CPA firm.

Anti-Money Laundering Compliance: Bringing issuers under the Bank Secrecy Act to meet financial institution-level AML obligations.

Priority user protection: When an issuer goes bankrupt, stablecoin holders' claims take precedence over other claimants.

Clear regulatory ownership: Clearly stipulate that payment stablecoins do not belong to the category of securities, commodities or investment companies, and draw a clear regulatory boundary.

In short, as the first federal-level stablecoin bill, the GENIUS Act has been widely regarded by the industry as an important development for stablecoins to move out of the wild growth stage, officially enter the scope of compliance, and is expected to move towards the broader market such as payments.

It is precisely because of the importance of the GENIUS Act that many parties in the industry have invested in lobbying efforts in order to get through the legislative process as soon as possible and successfully land.

After the Senate, what is left?

According to the U.S. legislative process, if the GENIUS Act can successfully run through the Senate, it will still be voted on by the House of Representatives, and then submitted to President Trump for signature before it finally becomes law.

Barron's reported that the bill is expected to go more smoothly in the House of Representatives, which does not need an absolute majority to approve it.

How has the market reacted?

Perhaps due to the positive blessing of the GENIUS Act, which has already made a key breakthrough in the Senate, the crypto market, which suffered a large correction yesterday, has seen a strong rebound today - BTC is back above the $106,000 mark, and a new high seems to be just around the corner.

Looking forward to the market changes after the implementation of the GENIUS Act, as the first step towards compliance and a broader market for stablecoins, the bill is undoubtedly a huge positive for the entire industry, and some of the projects whose business content is highly related to stablecoins have benefited greatly - for example, entering Aave (AAVE), Pendle (PENDLE), and Frax (FRAX) have all seen large increases that are better than the overall performance of the market; In addition, Ethereum (ETH), as the main front for the current compliant stablecoin issuance, may also be able to capture greater capital inflows.

Within the stablecoin market, the GENIUS Act, which clearly requires federal and state dual licensing supervision, may also become an opportunity for a track-level reshuffle, and Circle (USDC), which has long followed the compliance route and is registered in the United States, and the Trump family project WLFI (USD 1) may receive stronger compliance endorsements, while Tether (USDT), the king of the current stablecoin track, may face greater regulatory challenges due to problems such as overseas registration and questionable transparency. In response, Tether has officially announced plans to launch a new stablecoin in the United States, and Tether has recently lobbied in Washington to try to promote more friendly policies.

However, these are the final steps of the GENIUS Act, and for now, the top priority in front of the bill will be the final vote in the Senate that will take place in a maximum of 30 hours, when Odaily will follow up on the results of the vote.

Show original

1.31K

0

Chanh Doro

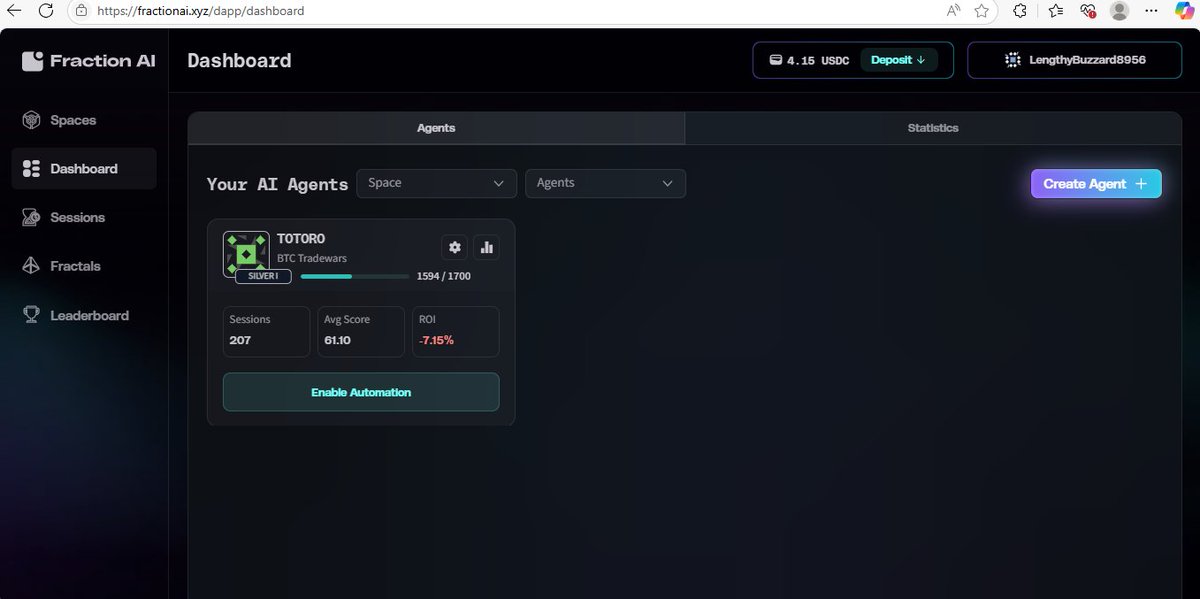

✨Fraction AI has opened to the public for everyone to play gamble-to-earn, no need for WL anymore.

♻️For those who have played the testnet and already have FRAC, you can consider playing the mainnet because FRAC will be combined from both testnet and mainnet. For newcomers, you might want to skip it; you could end up losing big.

♻️Currently, there are 2 pools to play:

🔸Pool Bid Tac Toe

Minimum $0.1 per game

🔸Pool BTC Tradewars

Minimum $0.25 per game

♻️I burned 6u and managed to play over 200 sessions. The amount of FRAC earned is unclear as I forgot to keep track. Generally, in the first 100 sessions, I won consistently, but after 100 sessions, I only lost, even after optimizing the Prompt multiple times.

Show original

201

0

常为希 |加密保安🔸🚢🇺🇸

"Ten Years Later"

1. Commercial use of quantum computers

2. Google dominates the quantum field, Nvidia lags behind 3, BTC and ETH anti-quantum algorithm upgrades are completed 4, quantum computers appear, and existing cancer, AIDS, etc. are all covered

take

5. The life expectancy of the rich relies on the medical revolution triggered by quantum technology

Broken 200 years old

6. The price of BTC exceeds that of gold, about $1 million a piece7. ETH becomes the on-chain infrastructure, $100,000 a piece

Show original980

0

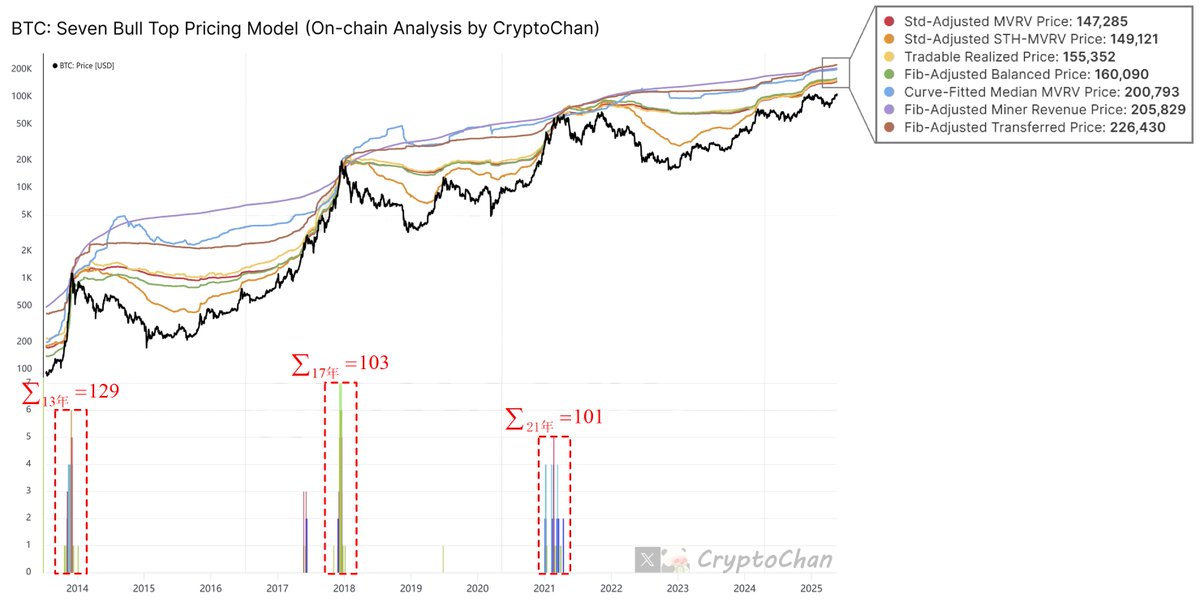

CryptoChan

#BTC [Seven Finger Capping Map] update, current——

🔴 The value of the Bull Top indicator is: $147,285

🟠 The value of the bull top indicator is: $149,121

🟡 The value of the Bull Top indicator is: $155,352

🟢 The value of the bull top indicator is: $160,090

🔵 The value of the bull top indicator is: $200,793

🟣 The value of the bull top indicator is: $205,829

🟤 The value of the Bull Top indicator is: $226,430

It is worth mentioning that the situation where the currency price breaks through the above 7 indicators will be used as points (on a daily basis, the currency price on the day will be 0 points if it exceeds 0, 1 point will be awarded if it breaks through 1, and so on for accumulation)——

During the 2013 bull top, the total number of points was 129

During the 2017 bull top, the total points were 103

During the first top of 2021, the total number of points was 101

Currently, the total number of points is 0

Concentrate:

🔴 The indicator is Std-Adjusted MVRV Price, which is designed based on the positive standard deviation of the Bitcoin MVRV indicator;

🟠 The indicator is Std-Adjusted STH-MVRV Price, which is designed based on the positive standard deviation of the MVRV indicator for short-term Bitcoin holders;

🟡 The indicator is Fib-Adjusted Balanced Price, which is designed by multiplifying the Balanced Price of Bitcoin in the Fibonacci sequence;

🟢 The indicator is Tradable Realized Price, which is designed based on Realized Cap and on-chain liquidity chips;

🔵 The indicator is Curve-Fitted Median MVRV Price, which is designed by fitting the curve (function) to the peak of the calendar cycle of the median MVRV of Bitcoin.

🟣 The indicator is the Fib-Adjusted Miner Revenue Price, which is designed by multiplifying the dollar income of Bitcoin miners from mining in Fibonacci sequences;

🟤 The indicator is Fib-Adjusted Transferred Price, which is designed by multiplifying the Transferred Price of Bitcoin in the Fibonacci sequence

Show original

1.03K

0

BTC calculator

Bitcoin price performance in USD

The current price of Bitcoin is $105,775.8. Over the last 24 hours, Bitcoin has increased by +2.07%. It currently has a circulating supply of 19,867,118 BTC and a maximum supply of 21,000,000 BTC, giving it a fully diluted market cap of $2,099.56B. At present, the Bitcoin coin holds the 1 position in market cap rankings. The Bitcoin/USD price is updated in real-time.

Today

+$2,147.90

+2.07%

7 days

+$4,062.40

+3.99%

30 days

+$20,603.80

+24.19%

3 months

+$9,131.40

+9.44%

Popular Bitcoin conversions

Last updated: 20/05/2025, 11:59

| 1 BTC to USD | $105,680.0 |

| 1 BTC to SGD | $136,874.2 |

| 1 BTC to PHP | ₱5,888,174 |

| 1 BTC to EUR | €94,031.11 |

| 1 BTC to IDR | Rp 1,736,159,027 |

| 1 BTC to GBP | £79,113.74 |

| 1 BTC to CAD | $147,589.5 |

| 1 BTC to AED | AED 388,159.5 |

About Bitcoin (BTC)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Learn more about Bitcoin (BTC)

Bitcoin's Rollercoaster Week: Ethereum Dips Amid Liquidations and Inflation Concerns

Bitcoin Hits $106,000 Before Tumbling Back Bitcoin experienced a volatile start to the week, surging to $106,000 before slipping 3.8% to $102,450 within hours on Monday. This dramatic movement led to $178.46 million worth of liquidations in the past 24 hours, according to CoinGlass, with an almost equal split between long and short positions.

20 May 2025|OKX

Understanding the Rise of Bitcoin ETFs: A New Era in Cryptocurrency Investment

Introduction to Bitcoin ETFs Bitcoin ETFs (Exchange-Traded Funds) have become a pivotal financial product, offering a regulated and accessible way for investors to gain exposure to Bitcoin without directly owning the cryptocurrency. These funds are traded on traditional stock exchanges, similar to stocks, and track the price of Bitcoin, providing a simpler entry point into the world of cryptocurrency for both individual and institutional investors.

19 May 2025|OKX

Bitcoin's Surge and World Mobile Token: A Comprehensive Overview

Bitcoin's Recent Surge Bitcoin has recently surpassed the $100,000 mark, marking its highest value since February. This remarkable increase was driven by positive developments in global trade, particularly the announcement of a trade agreement between the United States and the United Kingdom. The cryptocurrency saw a rise of over 4% in a single day, peaking at $100,801.

14 May 2025|OKX

Could Bitcoin (BTC) be headed for a continued downtrend? A Look At How It Might Perform With Current Economic Challenges

Economic Policies and Their Impact on Bitcoin Recent economic policies, particularly those from the U.S. administration, are creating significant headwinds for risk-on assets like Bitcoin. The focus on reducing the U.S. deficit through government spending cuts, tariffs, and immigration policies is expected to impact the economy over the next six to nine months. These measures, while aimed at stabilizing the economy, could lead to a slow and painful market downturn.

8 Apr 2025|OKX

Bitcoin FAQ

How much is 1 Bitcoin worth today?

Currently, one Bitcoin is worth $105,775.8. For answers and insight into Bitcoin's price action, you're in the right place. Explore the latest Bitcoin charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Bitcoin, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Bitcoin have been created as well.

Will the price of Bitcoin go up today?

Check out our Bitcoin price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

BTC calculator

Socials