MartingaleMastery

MartingaleMastery

1Following

21Followers

Strategy classification:

1. The long-term strategy was tested and survived and arbitraged in the BTC crash of May and November '21 and April '24. Earn a steady revenue with these strategies.

2. The short-term strategy (< 30 days) is based on the recent cryptocurrency, stock market and economic environment, maintaining a low drawdown while maximizing gains. These strategies are riskier than the long term, and I will turn on/off them in a timely manner depending on the marketplace conditions.

Control Risks:

During the testing period, > 30% margin to maintain the survival of the bot.

Personally, I take the safe route and use a higher margin. Margin Conversion:

10X Leverage: 100% of the initial investment

Don't use "Auto-conversion margin". I personally tested that it will be flattened when there is a lot of volatility.

If you have any questions, please contact us by email:

humble.sculls.0r@icloud.com

Show original

Overview

Futures trades

Spot trades

Bot trades

Stats

Total PnL%+74.49%

Total PnL+$15,944.02

Assets$35,586.73

Days active341

Max drawdown-36.79%

Win rate

71.90%Profit/loss ratio

1:0.70Net transfer$15,770.56

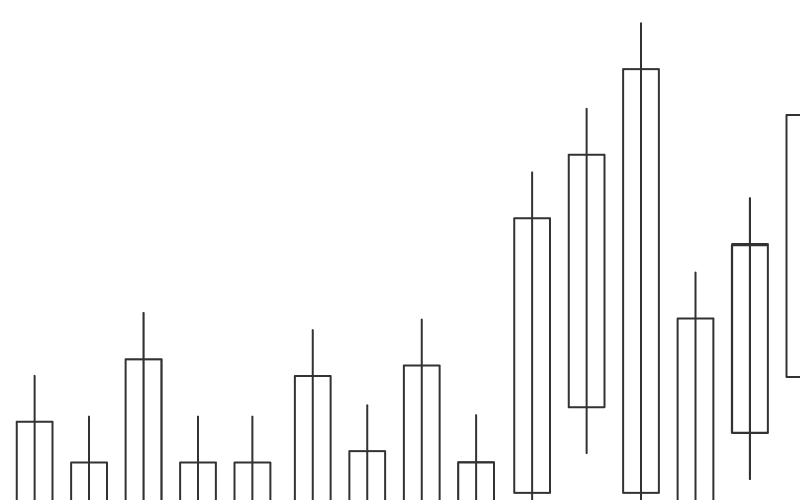

PnL%

PnL

Assets

--

Positions (10)

Assets

Latest records

Open positions

History

Open positions

1.53x long

PnL

+35.81 USDT

PnL%

+14.85%

Size

--

Margin

241.17 USDT

Maintenance margin ratio

5,210.90%

Entry price

4.99

Mark

5.23

Est liq. price

3.35

PnL

+72.79 USDT

PnL%

+28.44%

Size

--

Margin

257.03 USDT

Maintenance margin ratio

5,604.10%

Entry price

1.92

Mark

2.1

Est liq. price

1.28

PnL

-25.61 USDT

PnL%

-24.87%

Size

--

Margin

155.26 USDT

Maintenance margin ratio

2,233.44%

Entry price

0.3

Mark

0.28

Est liq. price

0.15

PnL

-115.23 USDT

PnL%

-37.95%

Size

--

Margin

353.46 USDT

Maintenance margin ratio

4,278.62%

Entry price

0.21

Mark

0.18

Est liq. price

0.13

PnL

-323.4 USDT

PnL%

-37.10%

Size

--

Margin

1,080.38 USDT

Maintenance margin ratio

4,720.01%

Entry price

2.51

Mark

2.2

Est liq. price

1.48

PnL

+24.9 USDT

PnL%

+2.55%

Size

--

Margin

989.48 USDT

Maintenance margin ratio

4,891.60%

Entry price

3.86

Mark

3.89

Est liq. price

2.58

PnL

-713.54 USDT

PnL%

-46.91%

Size

--

Margin

1,742.26 USDT

Maintenance margin ratio

1,303.64%

Entry price

5.73

Mark

4.84

Est liq. price

3.62

PnL

-4,000.96 USDT

PnL%

-93.69%

Size

--

Margin

8,304.81 USDT

Maintenance margin ratio

5,512.38%

Entry price

1,941.02

Mark

1,577.3

Est liq. price

1,191.41

PnL

+3,899.7 USDT

PnL%

+444.31%

Size

--

Margin

2,389.64 USDT

Maintenance margin ratio

11,025.22%

Entry price

58,513.36

Mark

84,511.4

Est liq. price

42,774.96