Quantitative&hedging

Quantitative&hedging

10Following

0Followers

1. The trend indicator enters and exits the market

2. Start hedging against the big indicator

3. Set the total amount of the first order at 1% of the total position × 20 times

4. The reverse direction is covered up to 4 times, plus the first position for a total of 5 positions, and each indicator cycle will increase

5. The profit direction is to chase up to 2 positions, plus the first order for a total of 3 positions

6. Cover the position to achieve the profit of the whole position, and if the whole position is not reached, the arbitrage will be divided into positions, and the long-short arbitrage will reach 1% of the cumulative profit, and the No. 1.2 robot will clear the bottom position of the long and short double-flat.

7. The period of making an order indicator is large, more than 4 hours

8. Advantages: Unilateral market advantages are large, profits will be high, and you can hold orders

This is an AI translation and is for reference only.

Show in original language

Futures trades

Personal trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit45Days w/ loss39

Win rate

53.57%Profit/Loss ratio

1.06:1Average position value

88.24Lead trader overview

Days leading trades

83Lead trade assets (USDT)

712.26AUM

0.00Current copy trader PnL (USDT)

0.00Copy traders0/50

Profit-sharing ratio

8%Copy traders

Cumulative total0

Change in last 7 days

--

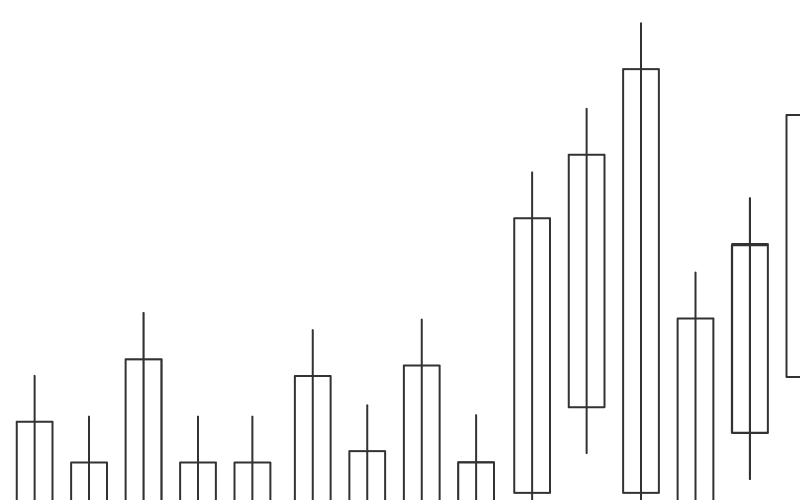

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences