MartingaleMastery

MartingaleMastery

1關注

21粉絲

策略分類:

1. 長線策略經過測試,在21年5月和11月以及24年4月的BTC大跌環境下,照樣存活並且套利。 用這些策略獲取穩定收入。

2. 短線策略(<30天)基於近期數字貨幣,股市以及經濟大環境,保持較低回撤的同時最大化收益。 這些策略風險比長線高,我會根據市場狀況及時開啟/關閉這些策略。

控制風險:

測試期間,>30%保證金即可維持策略生存。

我個人走穩妥路線,採用更高保證金。 保證金換算:

10X槓桿:初始投資的100%

切記不要使用「自動轉化保證金」。 本人親測,用在個波動大的時候會被平倉。

若有疑問,請郵件諮詢:

humble.sculls.0r@icloud.com

查看原文

概況

合約帶單

現貨帶單

策略帶單

數據總覽

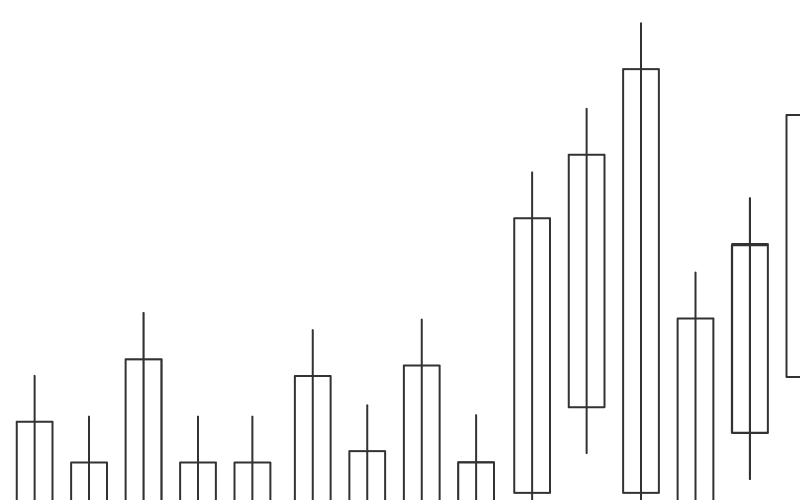

總收益率+74.28%

總收益額+$15,897.62

資產$35,540.33

入駐時長341

最大回撤-36.79%

勝率

71.90%盈虧比

1:0.70淨轉入$15,770.56

收益率

收益額

資產

--

倉位 (10)

資產

最新操作記錄

當前倉位

歷史倉位

當前持倉

多 1.53x

收益額

+34.5 USDT

收益率

+14.31%

持倉量

--

保證金

241.17 USDT

維持保證金率

5,195.27%

開倉均價

4.99

標記價格

5.22

預估強平價

3.35

收益額

+71.4 USDT

收益率

+27.90%

持倉量

--

保證金

257.03 USDT

維持保證金率

5,589.62%

開倉均價

1.92

標記價格

2.09

預估強平價

1.28

收益額

-25.11 USDT

收益率

-24.38%

持倉量

--

保證金

155.26 USDT

維持保證金率

2,238.10%

開倉均價

0.3

標記價格

0.28

預估強平價

0.15

收益額

-116.07 USDT

收益率

-38.23%

持倉量

--

保證金

353.46 USDT

維持保證金率

4,268.04%

開倉均價

0.21

標記價格

0.18

預估強平價

0.13

收益額

-327.56 USDT

收益率

-37.58%

持倉量

--

保證金

1,080.38 USDT

維持保證金率

4,702.61%

開倉均價

2.51

標記價格

2.19

預估強平價

1.48

收益額

+18.82 USDT

收益率

+1.93%

持倉量

--

保證金

989.48 USDT

維持保證金率

4,872.28%

開倉均價

3.86

標記價格

3.89

預估強平價

2.58

收益額

-716.72 USDT

收益率

-47.12%

持倉量

--

保證金

1,742.26 USDT

維持保證金率

1,300.68%

開倉均價

5.73

標記價格

4.83

預估強平價

3.62

收益額

-4,013.38 USDT

收益率

-93.98%

持倉量

--

保證金

8,304.81 USDT

維持保證金率

5,500.40%

開倉均價

1,941.02

標記價格

1,576.17

預估強平價

1,191.41

收益額

+3,894.24 USDT

收益率

+443.69%

持倉量

--

保證金

2,389.64 USDT

維持保證金率

11,020.39%

開倉均價

58,513.36

標記價格

84,475

預估強平價

42,774.96